- Markets

Find out what influences market movements by browsing through our tailor made product pages.

- Trading Platforms

Maximise your investment opportunities

Trading Platforms

In order to ensure our customers have the best trading experience. We are proud to introduce our suite of trading platforms.

- Accounts

All accounts can be opened using one application form.

OPEN A LIVE ACCOUNT

The application process is simple and straightforward. You can complete the online application form and be trading in minutes.

- Academy

Here you will find all the details regarding One Financial Markets educational offering

TRADING ACADEMY

Working through each of our six online modules, detailed below, you can develop your trading confidence

- Newsroom

The latest news in the Financial Markets from across the globe.

LATEST NEWS

Make sure you don't miss out on what's going on in the world around you, keep up to date with our market commentary and daily market update videos.

- Contact Us

The EUR/USD pair closed the day marginally higher, right below the 1.0590 level

16th February 2017

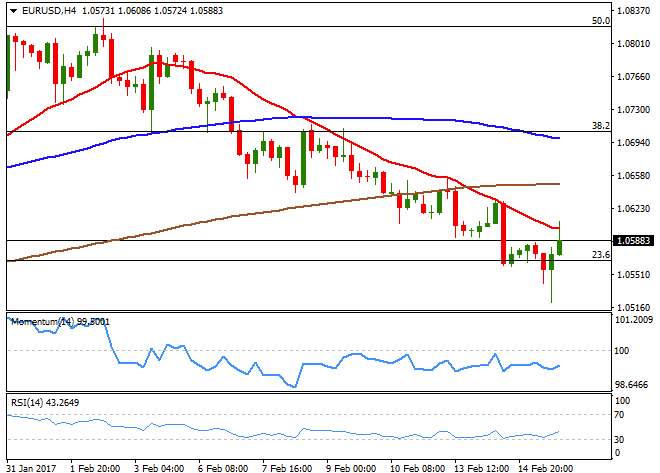

EUR/USD

The EUR/USD pair closed the day marginally higher, right below the 1.0590 level, despite US inflation and retail sales upbeat data strengthen the case for a March hike. The dollar advanced modestly during the European morning as no relevant data came from Europe, with the greenback benefiting from the echoes of Yellen's hawkish testimony before the US Congress. The EUR/USD pair fell down to 1.05231, after news showed that US inflation rose sharply in January, with year-on-year inflation reaching 2.5%, and the core reading up to 2.3%. Retail Sales rose by 0.4% in the same month, while the core reading ex-autos, advanced 0.8%. Finally, the New York Empire State Manufacturing index for February surged to 18.7, a strong bounce from previous 6.5, and the highest reading in over two years.

The late intraday recovery was not enough to revert the negative tone of the pair, as in the 4 hours chart, the recovery stalled right around a still bearish 20 SMA. Furthermore and in the same chart, technical indicators have posted moderate bounces from their mid-lines, but remain well into negative territory. The pair has briefly broke below the 1.0565 Fibonacci support before recovering above it, but renewed selling interest below the level will likely result in fresh weekly lows, particularly if hopes about the upcoming US tax reform keep fueling sentiment. Additional gains beyond 1.0625, the immediate resistance, could result in a recovery up to the 1.0660 region, en route to the critical 1.0705 price zone.

Support levels: 1.0565 1.0520 1.0470

Resistance levels: 1.0625 1.0660 1.0705

USD/JPY

The USD/JPY pair retreated from a fresh weekly high of 114.95 to close the day flat in the 114.20 region. The greenback got a boost from much better-than-expected inflation and retail sales January data, but was unable to sustain gains and plummeted to 113.85 as the dollar index suffered a sharp reversal after printing a 4-week high of 101.73. Bank of Japan Governor Haruhiko Kuroda spoke early Wednesday, but said nothing new, noting that policy makers have no plan to raise the central bank's bond yield targets, and that inflation is still far from the 2% target. There are no major economic releases scheduled for this Thursday. From a technical point of view, the pair still has to firm up above 114.55, the 23.6% retracement of the November/December rally, to be able to recover further. In the 4 hours chart, the price is struggling around a bearish 200 SMA, whilst technical indicators turned south from near overbought readings, indicating that buying interest is still limited. The 100 SMA in the mentioned char stands flat around 113.35, with a break below it most likely resulting in a bearish extension during the following sessions.

Support levels: 113.85 113.35 112.90

Resistance levels: 114.55 114.90 115.40

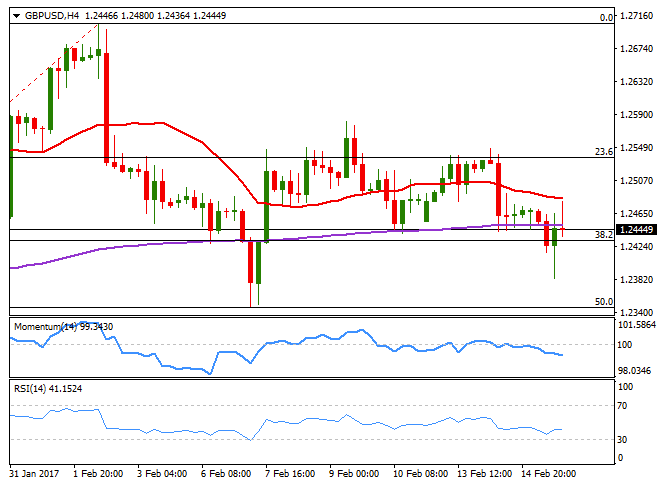

GBP/USD

A mixed UK employment report weighed on the Pound, resulting in the GBP/USD pair falling to a fresh weekly low of 1.2382, with the decline further accelerating after the release of strong US data which backed the case for a US March rate hike. Official figures showed that the UK is getting closer to full employment, as the employment rate rose to 74.6% in the three months to December, the highest rate since the stats begun back in 1971, whilst the unemployment rate remained steady at an eleven-year low of 4.8%. Average hourly earnings including bonus, however, rose 2.6% in the same period, below previous 2.8%, the slower pace in almost two years. In January, unemployment claims fell by 42.4K much better than the 0.8K expected. Weak earnings in a rising inflation environment, may affect overall economic growth during the upcoming months. The pair, however, recovered ground on dollar's late reversal, ending the day around 1.2440, unable to surpass Tuesday's low. From a technical point of view, the pair is bearish, given that in the 4 hours chart, the late spike was contained by selling interest around a bearish 20 SMA, whilst technical indicators maintain modest bearish slopes within negative territory. The pair has an immediate support at 1.2430, the 38.2% retracement of its latest bullish run, followed by the mentioned daily low. Below this last, the pair has scope to extend down to the 1.2330/50 region a major support area that will likely hold on a first attempt to break lower.

Support levels: 1.2430 1.2380 1.2345

Resistance levels: 1.2500 1.2535 1.2585

AUD/USD

The Australian dollar posted a solid advance for a second consecutive day against its American rival, with the pair ending the day a few pips below the 0.7700 threshold after posting a fresh three-month high of 0.7708. The commodity-related currency was backed at the beginning of the day by a recovery in consumers' confidence, as the Westpac-Melbourne Institute survey of consumer sentiment rose 2.3% to 99.6 in February, following a gain of just 0.1% the previous month. Dollar's intraday strength was not enough to push the pair below the base of its latest range, the 0.7600, with the u-turn of the American currency fueling the advance of the already strong AUD. During the upcoming Asian session, Australia will release its January employment figures, with the unemployment rate expected to remain flat at 5.8% and 10,000 new jobs added in the month. Better-than-expected figures can boost the AUD/USD pair pass the 0.7700, but is still to be seen if gains beyond the level could be sustainable in time, as ever since last April, spikes beyond the level have been quickly reverted, and in fact triggered strong downward corrective moves. Short term, the 4 hours chart favors additional gains, as technical indicators have accelerated their advances within positive territory, whilst the 20 SMA gains bullish strength, currently at 0.7665 November 2016 high at 0.7778, is a possible bullish target, but as higher the advance, the higher the risk of a quick reversal.

Support levels: 0.7665 0.7610 0.7570

Resistance levels: 0.7710 0.7745 0.7790

Dow Jones

The positive momentum of US equities sent the three major indexes to all-time highs for a fifth consecutive session, with the Dow Jones Industrial Average adding 107 points to close at 20,611.58. The Nasdaq Composite added 36 points, to end at 5,819.44 whilst the S&P settled at 2,349.25, up 0.50%. The unstoppable rally was fueled by comments from US President Trump, who reaffirmed a massive tax reform will come in the "not-too-distant future." Banks were again among the best performers, with JP Morgan Chase up 1.15% and Goldman Sachs adding 0.47%. The DJIA daily chart shows that technical indicators keep heading sharply higher, despite being in extreme overbought territory, with the RSI indicator at 81, whilst the index is far above a bullish 20 DMA, a reflection of the ongoing buying fever. In the 4 hours chart, the technical picture is quite alike, with the RSI indicator still heading north around 87, the Momentum barely retreating within extreme overbought readings and the benchmark far above bullish moving averages. As long as optimism about upcoming policies aimed to boost growth and inflation in the US persist, equities will continue rallying, despite whatever extreme readings indicators mark.

Support levels: 20,609 20,552 20,506

Resistance levels: 20,650 20,700 20,750

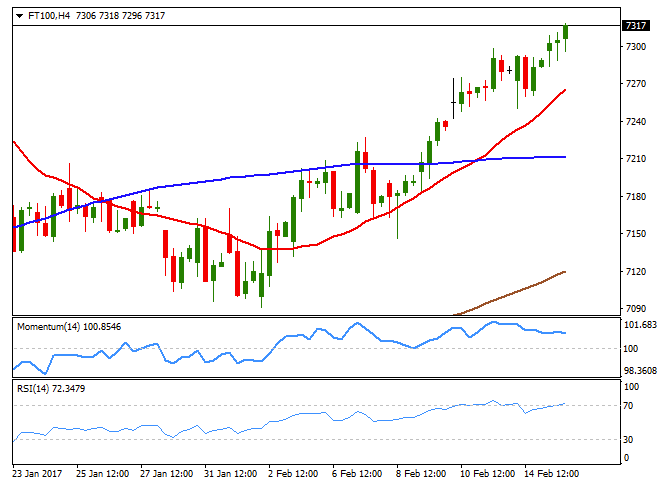

FTSE 100

The FTSE 100 closed at 7,302.41, up by 33 points or 0.47%, with the banking sector leading the way higher across the region. The index reached an almost one month high, further fueled by a weakening Pound. Ashtead Group was the best performer, up 3.20%, followed by Barclays that added 2.97%. Standard Chartered gained 2.66% while Royal Bank of Scotland closed 2.07% higher. The mining sector ended mixed, with BHP Billiton up 2.90%, but Antofagasta down 1.98% and Anglo American closing 1.03% lower. The index retains the bullish tone in its daily chart, holding above a flat 20 SMA and with technical indicators heading north within positive territory, still poised to retest the record high posted last January at 7,354, now the immediate resistance. In the 4 hours chart, the index is well above a bullish 20 SMA, but the Momentum indicator continues diverging lower within positive territory, whilst the RSI lost upward strength in overbought territory, none of them enough to confirm a bearish move, but acting as an immediate warning over a possible correction.

Support levels: 7,296 7,254 7,208

Resistance levels: 7,354 7,390 7,425

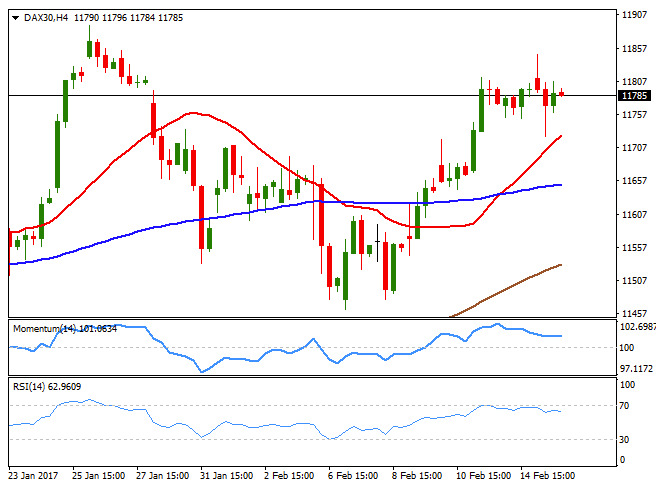

DAX

European equities closed with modest gains, with the banking sector leading the way higher following hawkish comments made by Federal Reserve Chairwoman Janet Yellen. The German DAX added 22 points or 0.19% to close at 11,793.93, with Deutsche Bank leading gainers' list, up 2.06%. Commerzbank added 2.01%. The German benchmark advanced to a fresh 3-week high of 11,848, and despite the lack of clear momentum coming from technical readings, sentiment favors a bullish extension for the upcoming days. In the daily chart, the DAX continues developing above a horizontal 20 DMA, but far above bullish 100 and 200 DMAs. Indicators in the mentioned chart are flat, with the Momentum around 100, but the RSI at 62, supporting the bullish case. In the 4 hours chart, the 20 SMA continues advancing below the current level, with an approach to it having been quickly reverted, whilst technical indicators are aiming higher after correcting overbought conditions reached earlier this week.

Support levels: 11,745 11,694 11,640

Resistance levels: 11,848 11,891 11,935

Nikkei

The Nikkei trimmed almost all of its Tuesday's losses, advancing 199 points or 1.03%, to settle at 19,437.98 this Wednesday. Asian shares got a boost from optimism in Wall Street that settled at all-time highs after FED's head Yellen hawkish comments. Within the Nikkei, only 32 components closed in the red, with Toshiba being the worst performer, down 7.62%, on news that its chairman will most likely resign, following the failure of its nuclear power business. The index stands around its daily close ahead of the Asian opening as despite some wild intraday swings, the USD/JPY pair held above the ¥114.00 level. The index daily chart shows that the Momentum indicator has bounced modestly from its 100 level, whilst the RSI indicator consolidates around 57, and the 20 DMA slowly gains upward strength well below the current level, all of which limits the negative side. In the shorter term, and according to the 4 hours chart, the benchmark presents a neutral bias, as it's stuck around a still bullish 20 SMA, whilst technical indicators have turned lower, but hover around their mid-lines with no certain directional strength.

Support levels: 19,385 19,310 19,240

Resistance levels: 19,529 19,575 19,637

Gold

Spot gold bounced sharply from a daily low of 1,216.64, ending the day around $1,231.60 a troy ounce. The recovery was limited, as US data released this Wednesday backed Yellen's Tuesday comments about being risky to wait too long to raise rates, as inflation pressures are increasing. Dollar bulls rushed to take profits after the currency reached some critical levels against its major rivals, resulting in a strong intraday reversal that anyway is not enough to confirm an interim top. In the case of stop gold, the daily chart shows that the price bounced sharply after testing its 20 DMA, still advancing below the 100 DMA, whilst technical indicators are attempting to recover after a modest downward correction from overbought readings. In the 4 hours chart, the price is slightly above a flat 20 SMA whilst technical indicators head higher around their mid-lines, with limited upward strength. While further gains are not technically confirmed the risk of a bearish move seems well-limited according to technical readings, with only a break below the 1,200 level indicating a steeper decline afterwards.

Support levels: 1,221.80 1,210.10 1,200.00

Resistance levels: 1,237.10 1,244.70 1,252.90

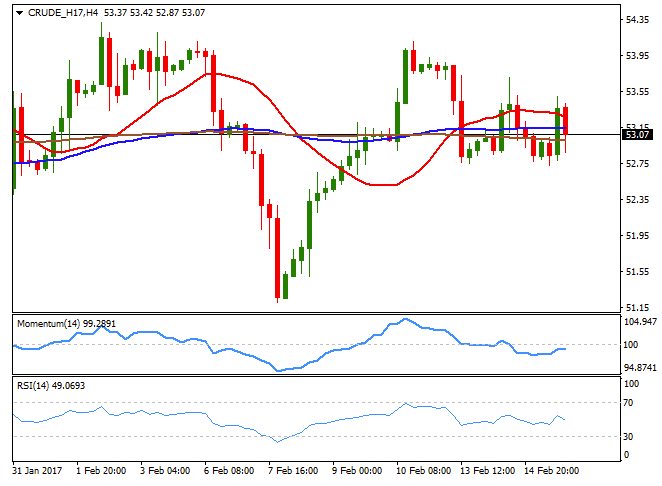

WTI Crude Oil

West Texas Intermediate crude oil futures closed flat for a second consecutive day a few cents above $53.00 a barrel, as large US stockpiles builds dented optimism about OPEC's output cut. US crude stocks rose 9.5 million barrels according to the EIA, much more than the 3.7 million expected, while gasoline stockpiles rose by 2.8 million barrels, also far beyond market's expectations. A decline in distillate stocks and crude oil imports partially offset the headline reading. Technically, the daily chart maintains the neutral stance seen on previous updates, with the price still stuck around a flat 20 SMA and technical indicators heading nowhere around their mid-lines. In the 4 hours chart, the price is trapped within horizontal moving averages, the Momentum indicator is flat below its 100 level, whilst the RSI indicator has turned south around its mid-line. Overall, the fundamental background favors a bearish extension, but it will take a break below 52.60 to confirm such move, with WTI then poised to test the key 50.00 figure.

Support levels: 52.60 52.00 51.40

Resistance levels: 53.70 54.40 55.20

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.