- Markets

Find out what influences market movements by browsing through our tailor made product pages.

- Trading Platforms

Maximise your investment opportunities

Trading Platforms

In order to ensure our customers have the best trading experience. We are proud to introduce our suite of trading platforms.

- Accounts

All accounts can be opened using one application form.

OPEN A LIVE ACCOUNT

The application process is simple and straightforward. You can complete the online application form and be trading in minutes.

- Academy

Here you will find all the details regarding One Financial Markets educational offering

TRADING ACADEMY

Working through each of our six online modules, detailed below, you can develop your trading confidence

- Newsroom

The latest news in the Financial Markets from across the globe.

LATEST NEWS

Make sure you don't miss out on what's going on in the world around you, keep up to date with our market commentary and daily market update videos.

- Contact Us

The EUR/USD pair closed the week with gains at 1.0777,

6th February 2017

EUR/USD

The EUR/USD pair closed the week with gains at 1.0777, not far from a fresh 2017 high of 1.0828, underpinned by persistent dollar's weakness, and backed at the last day of the week, by a mixed US Nonfarm Payroll report. The US Nonfarm Payrolls´ headline beat expectations by showing that the US economy added 227K new jobs in January, but the rest of the components were a big disappointment: the unemployment rate surged to 4.8% from previous and expected 4.7% whilst wage rose below expected. Average hourly earnings monthly basis rose by 0.1%, against a 0.2% advance expected, while yearly basis, it came in at 2.5% from previous 2.9%. Final readings for November and December were revised, resulting in 39,000 new jobs less than initially estimated in those two months.

In Europe, the Markit final PMI's for January confirmed that the EU growth´s pace accelerated at the beginning of 2017, with modest downward revisions to manufacturing figures, but stronger ones in the services sector, resulting in stronger Composite PMIs for January. Inflation in the area rose by more than expected, up by 1.7% in 2016, while Q4 GDP came in at 0.5% matching expectations and leaving the annual rate of growth at 1.8%. Unemployment in the euro area fell to 9.6 percent in December down from 9.7 percent in November.

From a technical point of view, the pair is poised to extend its advance according to technical readings in the daily chart, as indicators have recovered from a downward correction within positive territory, maintaining their bullish slopes. In the same chart, the 20 DMA presents a bullish slope, hovering near the 1.0710 Fibonacci support, the 38.2% retracement of the November/January decline, while the 100 DMA maintains a bearish slope, a few pips above the region. In the 4 hours chart, the price is stuck around a bullish 20 SMA, but the 100 SMA stands also in the 1.0700/10 region, while technical indicators turned higher in neutral territory. The 50% retracement of the mentioned slide stands around 1.0820, while the 1.0800/40 region has proved strong all through 2015 and 2016, being the resistance area to beat to confirm a steeper advance this week.

Support levels: 1.0750 1.0710 1.0650

Resistance levels: 1.0800 1.0840 1.0885

USD/JPY

The USD/JPY pair flirted with the 112.00 level twice during this past week and settled at 112.54, its lowest since late November 2016. Broad dollar's weakness weighed on the pair following the release of a mixed US job's report, which showed soft wages' growth. On Friday, US stocks closed higher, while US Treasury yields recovered to close the week with gains, something that usually weighs on the Japanese currency, but didn't work this time, as speculative interest is starting to perceive the latest BOJ's monetary policy, focused on controlling the yield curve, as ineffective. Next February 10th, PM Abe will meet with Donald Trump, with both leaders aiming to deepening the bilateral trade and investment relationship, according to the White House. The pair is biased lower for these upcoming days, although the mentioned 112.00 level is a major support, as it stands for the 38.2% retracement of the 101.18/118.66 rally. In the daily chart, the Momentum indicator was rejected from its 100 level, and heads sharply lower within negative territory, whilst the RSI presents a bearish slope, now around 40, in line with further slides. In the same chart, the 100 SMA heads higher around 111.25, the probable bearish target should the mentioned Fibonacci support give up. Shorter term and according to the 4 hours chart, the risk is clearly towards the downside, with the price developing below a bearish 100 SMA and technical indicators heading south within negative territory.

Support levels: 112.00 111.60 111.25

Resistance levels: 113.00 113.45 113.90

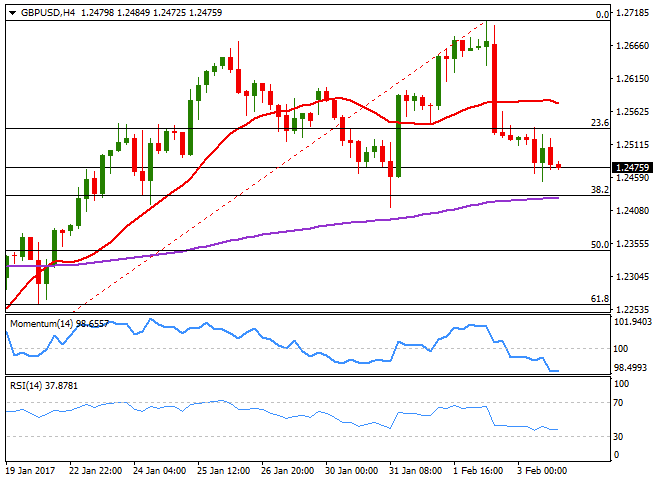

GBP/USD

The British Pound was the worst performer last week, the only major that gave up ground against the greenback. The GBP/USD pair plummeted to 1.2425 on Friday and settled at 1.2475, despite broad dollar's weakness, undermined by BOE's monetary policy outcome, as the Central Bank left its policy unchanged, but also its inflation forecast. The Central Bank still expects higher-than-tolerated inflation for this year and the next, but also confides that it will ease on its own by 2019, indicating that a rate hike is out of the table for now. On Friday, macroeconomic news disappointed, as the UK January Markit services PMI fell to 54.5 against December's 56.2 reading, in line with the soft manufacturing and construction figures released earlier this week. Also, weighing on Pound is the upcoming Brexit, as the UK government has formally set out its plans for exiting the EU with a 70-page white paper. The withdrawal bill will return to the House of Commons this week, and the vote is expected to be passed this Wednesday, clearing the path for PM May to trigger Article 50 on March as planned. From a technical point of view, the daily chart shows that the price held above the 38.2% retracement of the 1.1986/1.2705 rally at 1.2430, while a bullish 20 SMA reinforces the static support, heading higher a few pips below it. Technical indicators in the mentioned chart, however, hover within neutral territory, with the RSI heading lower around 51, indicating limited buying interest. In the 4 hours chart, the technical picture favors the downside, with indicators heading south near oversold readings, and the price well below the 20 SMA, this last around 1.2580.

Support levels: 1.2430 1.2390 1.2350

Resistance levels: 1.2495 1.2540 1.2585

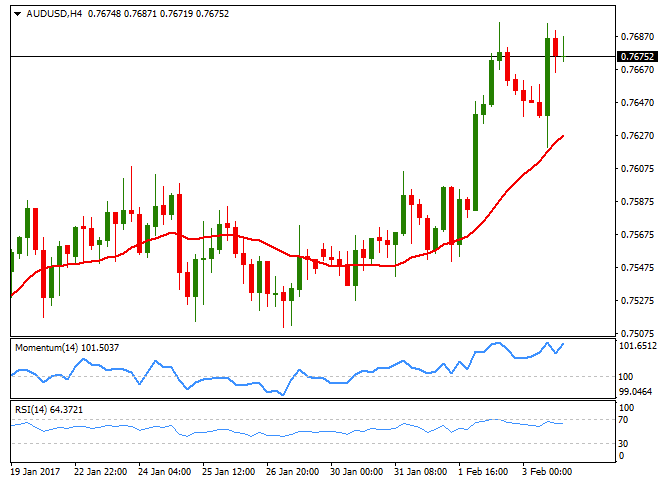

AUD/USD

The Australian dollar was among the best performers this past week, rallying up to 0.7695, to settle a few pips below the critical 0.7700 threshold. The Aussie surged sharply on Thursday, following the release of a record trade balance surplus of $3.5 billion for December, up from November's $2.04bn surplus. Exports rose by 5% in the month, helped by a 14% increase in coal and a 10% raise in iron-ore shipments, while imports rose by 1%. Also, Chinese Central Bank surprise intervention to weaken the Yuan on Friday, boosted the Aussie. The pair has finally broken the 0.75/0.76 range, and a break above 0.7700 could result in a retest of 2016 high in the 0.7830 region. Daily basis, technical indicators support additional gains, heading sharply higher well above their mid-lines, whilst the 20 DMA also heads north almost vertically, but well below the current level, indicating strong AUD's demand. In the 4 hours chart, the 20 SMA gained upward strength and acts as dynamic support, now around 0.7630, while the Momentum indicator resumed its advance near overbought readings and following a limited downward correction, whilst the RSI hovers around 64, all of which supports a new leg higher, particularly on a break above the mentioned high.

Support levels: 0.7630 0.7590 0.7550

Resistance levels: 0.7695 0.7735 0.7770

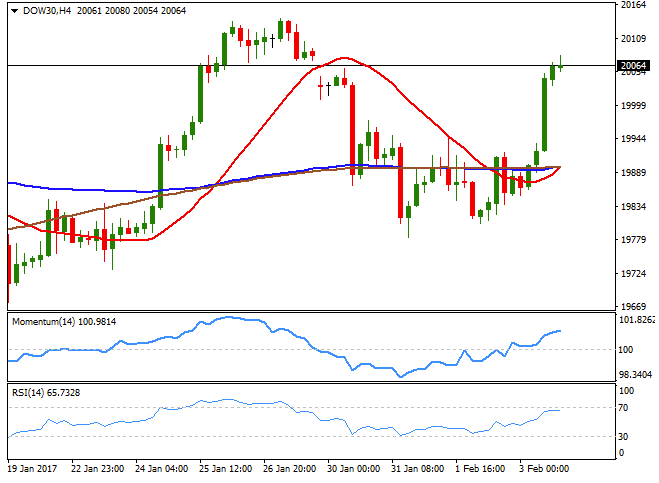

Dow Jones

Wall Street surged on Friday, with the Dow Jones Industrial Average settling at 20,071.46, up by 186 points or 0.94%, boosted by news that President Trump began working to curb financial regulations, by undoing parts of the Dodd-Frank reforms of the banking industry. The Dow settled lower for the week anyway, by 0.11%. The Nasdaq Composite added 30 points and closed at 5,666.77, whilst the S&P finished at 2,297,42, up 0.73%, both modestly up weekly basis. Financial stocks led the way higher, and within the DJIA, Visa was the best performer, up by 4.59%, followed by Goldman Sachs, up by 4.57% and JP Morgan which added3.06%. Nike was the worst performer, down 0.83%. Technically, the daily chart for the Dow shows that the index is not far from the record highs set last January, well above a flat 20 DMA, but far above a bullish 100 DMA, whilst technical indicators have bounced from their mid-lines, maintaining strong upward slopes ahead of Monday's opening. In the 4 hours chart, the moving averages converge at 19,900, the Momentum indicator maintains its bullish slope, while the RSI consolidates at 65, all of which maintains the risk towards the upside, favoring a new leg higher on a break above 20,080, Friday's high.

Support levels: 20,031 19,975 19,923

Resistance levels: 20,080 20,141 20,200

FTSE 100

The Footsie advanced on Friday, up 47 points or 0.67% to close at 7,188.30, helped by a recovery in financial-related equities. Barclay's was the best performer, advancing by 3.39%, followed by Prudential that added 2.09%. Royal Bank of Scotland closed 2.70% higher. Gains were offset by mining-oriented equities, as metal prices fell, with Glencore topping losers' list, down 4.77%, followed by Rio Tinto that shed 3.54% and Anglo American that closed 3.30% lower. The recovery was not enough to confirm further gains ahead, as in the daily chart, the 20 SMA caps the upside at 7,128, whilst technical indicators have turned modestly higher, with the Momentum still below the 100 line, but the RSI at 56, somehow anticipating an upward extension, to be confirmed by an upward acceleration through the mentioned resistance. In the 4 hours chart, the RSI indicator turned flat at 60, the Momentum heads higher within positive territory, whilst the index is trapped within horizontal moving averages, in line with the longer term perspective.

Support levels: 7,128 7,091 7,042

Resistance levels: 7,212 7,258 7,312

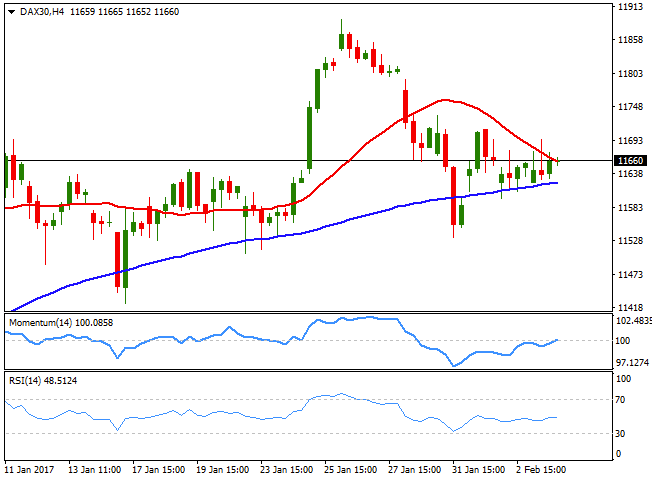

DAX

The German DAX edged modestly higher on Friday, adding 23 points or 0.20% to settle at 11,651.49, bud down for the week. Stocks across Europe opened with a soft tone and traded in the red for most of the session, weighed by Chinese monetary policy's measures, but recovered alongside with Wall Street following the release of the NFP report. Continental was the best performer, up by 3.81%, followed by Deutsche Bank that added 2.68%. Heidelberg Cement topped losers' list, down 1.21%. The daily chat shows that the index has been confined to a tight range during the second half of this past week, turning technically neutral, as the index is stuck around a horizontal 20 SMA, whilst indicators are flat around their mid-lines, lacking directional strength. In the 4 hours chart, the index is between its 100 and 200 SMAs, both within a 50 points, range, the RSI indicator is horizontal around 48, while the Momentum aims modestly higher around its 100 level, also lacking technical clues on what's next for the index.

Support levels: 11,609 11,550 11,000

Resistance levels: 11,711 11,770 11,804

Nikkei

The Nikkei 225 closed 3 points higher on Friday at 18.918.20, sharply higher, however, weekly basis and extending beyond the 19,000 threshold in after-hours trading, following Wall Street's advance. The benchmark stands at 19,069 ahead of the weekly opening, and weekend news point to a firm opening, after Toyota and Suzuki announced that they are near an agreement on a comprehensive partnership on development and procurement that could be announced as soon as this Monday. Also, pointing to an advance this Monday is the sharp recovery in financial-oriented equities seen in America last Friday. The daily chart for the Japanese index presents a limited upward potential at this point, with technical indicators stuck around their mid-lines and the 20 SMA capping the upside at 19,123, although an advance beyond this last would favor a new leg higher. In the 4 hours chart, the index is hovering around a flat 20 SMA, but below the 100 and 200 SMAs, whilst technical indicators head modestly lower within negative territory.

Support levels: 19,010 18,942 18,881

Resistance levels: 19,123 19,175 19,255

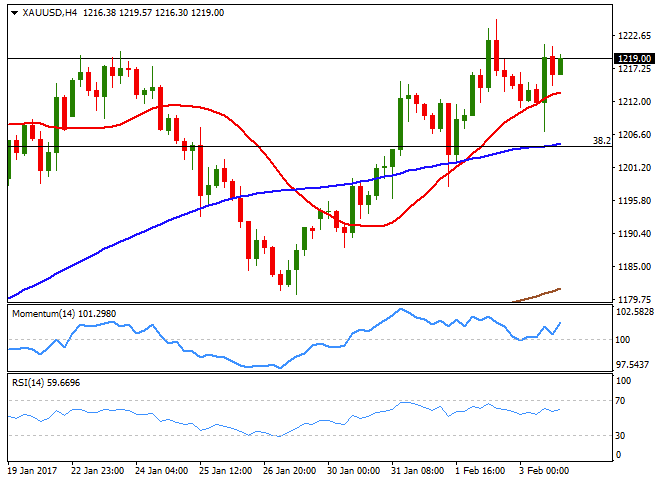

Gold

Spot gold recovered the ground lost in the previous week and closed last Friday at$1,219.00, its highest settlement since past November, backed by a neutral FED that gave no clues on upcoming rate hikes. Adding to gold's positive momentum is increasing global economic uncertainty and the continued unwind of the so-called "Trump-trade," as the new US administration failed to provide policies leading to a stronger economic expansion in the world's largest economy. On the contrary, the protectionist policies announced so far, indicate trade trouble ahead. Gold's daily chart shows that the Momentum indicator heads modestly higher above its 100 level, but that the RSI indicator accelerated its advance, standing now around 64, whilst the price settled above the 20 and 100 DMAs, both around 1,204/10, all of which supports additional gains. Around 1,230.00, the pair has the 50% retracement of the November/December slide, and an extension beyond it will probably indicating a steeper advance for this upcoming week. In the 4 hours chart, technical indicators are heading higher well above their mid-lines, whilst the 100 SMA converges with the 38.2% retracement of the mentioned decline at 1,204.50, providing a strong support in the case of downward move.

Support levels: 1,211.56 1,204.50 1,196.10

Resistance levels: 1,225.23 1,231.10 1,241.35

WTI Crude Oil

Crude oil prices advanced within range this past week, with West Texas Intermediate crude futures settling at $53.84 a barrel. The commodity remains trapped between positive news of output cuts within the OPEC, and negative ones that show that US production keeps increasing. Gains at the end of the week, however, were triggered by news that the US will impose sanctions to Iran after the country performed a ballistic missile test launch. WTI closed the day pretty much unchanged on Friday, holding near the upper end of its latest range with a neutral-to-bullish bias in the daily chart, given that the price stands above all of its moving averages that anyway lack directional strength, whilst technical indicators hover within positive territory, also without clear momentum. In the shorter term, the 4 hours chart the 20 SMA heads modestly higher, moving away from the 100 and 200 SMAs, while the price is above all of them, but technical indicators have turned lower within positive territory, indicating limited buying interest at current levels.

Support levels: 53.20 52.65 52.00

Resistance levels: 54.30 55.10 55.70

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.