- Markets

Find out what influences market movements by browsing through our tailor made product pages.

- Trading Platforms

Maximise your investment opportunities

Trading Platforms

In order to ensure our customers have the best trading experience. We are proud to introduce our suite of trading platforms.

- Accounts

All accounts can be opened using one application form.

OPEN A LIVE ACCOUNT

The application process is simple and straightforward. You can complete the online application form and be trading in minutes.

- Academy

Here you will find all the details regarding One Financial Markets educational offering

TRADING ACADEMY

Working through each of our six online modules, detailed below, you can develop your trading confidence

- Newsroom

The latest news in the Financial Markets from across the globe.

LATEST NEWS

Make sure you don't miss out on what's going on in the world around you, keep up to date with our market commentary and daily market update videos.

- Contact Us

The EUR/USD pair fell for a second consecutive day

8th February 2017

EUR/USD

The EUR/USD pair fell for a second consecutive day, ending the day below just below the 1.0700 threshold. The pair traded as low as 1.0655, with the common currency undermined by poor local data and increasing political turmoil. According to official data, German Industrial Production contracted by 3.0% during last December, resulting in a decline in the annual rate of growth to -0.7% from a previously revised 2.3% advance. Also, weighing on the EU was renewed political uncertainty in the region on news that Marine Le Pen is leading polls ahead of the Presidential election next April. Le Pen, has pledged to leave the EU and fight Islam if she becomes president.

The US released some minor macroeconomic reports that anyway were positive, as the IBD/TIPP Economic Optimism Index for February improved to 56.4 vs. 55.6 in January, with the index now 6.4 points above its 12-month average of 50.0. The US trade deficit narrowed in December to $44.3b, the first improvement in three months, whilst November reading was revised to -45.7b from a previous estimate of -45.2b.

Technically, the risk remains towards the downside, given that late recovery stalled below the critical 1.0700/10 resistance area that contained declines for over a week. In the 4 hours chart, the 20 SMA has accelerated its decline well above the current level, while the Momentum indicator accelerated its decline below the 100 level, and the RSI hovers around 40, this last with a limited upward slope. A recovery above the mentioned resistance could see the pair returning to the 1.0760/1.0800 region, but as long as below it the risk is towards the downside, with scope to extend its decline down to 1.0590 on a break below the mentioned daily low.

Support levels: 1.0650 1.0620 1.0590

Resistance levels: 1.0710 1.0750 1.0800

USD/JPY

The USD/JPY pair managed to advance up to 112.57 early US session after falling down to 111.58 at the beginning of the day, but resumed its decline and challenges the 112.00 region ahead of the Asian opening, with the pair following the lead of US yields. The 10-year benchmark fell down to 2.371% this Tuesday, down from Monday's 2.41% settlement, while US equities retreated after a strong start of the day, adding to Yen's bullish case. The Bank of Japan will release its Summary of Opinions during the upcoming Asian session, which includes fresh inflation and growth forecast. Seems unlikely the Central Bank will be less optimistic about inflation, in spite of recent data, and therefore is also unlikely that the pair will react to the news. From a technical point of view, the ongoing bearish trend in the USD/JPY pair remains firm in place, given that the pair is setting lower lows and lower highs daily basis, whilst in the 4 hours chart, the pair continues developing well below a bearish 100 SMA, currently at 113.54, whilst the RSI indicator resumed its decline, now around 41. The 100 DMA stands around 111.55 for this Wednesday, and renewed selling interest that pushes the price below the level should lead to a test of the 109.90 level, the 50% retracement of the latest bullish run.

Support levels: 111.55 111.25 110.80 Resistance levels: 112.10 112.60 113.00

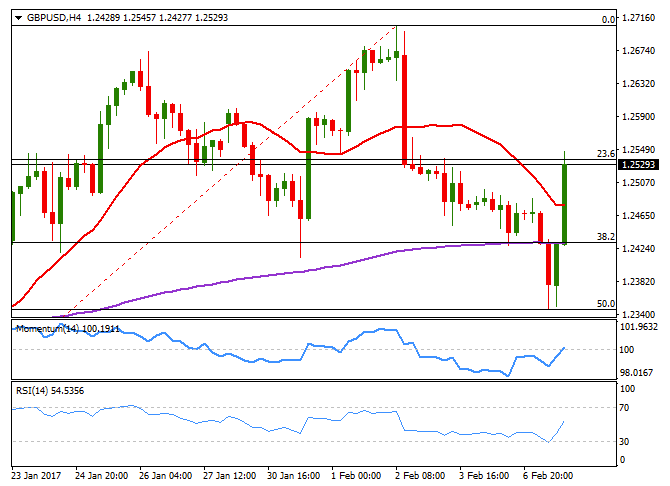

GBP/USD

The Pound fell to a fresh 2-week low against the greenback early Europe, to later jump to a fresh weekly high, on mounting speculation the BOE will have to raise rates sooner-than-expected. The GBP/USD pair fell to 1.2346, tracking poor UK data released during the first half of the day, confirming that rising inflation is starting to weigh on consumers' sentiment. The BRC like-to-like sales fell 0.6% in the year to January, below previous month reading when it stood at 1.0%. House prices also contracted according to the Halifax survey, down by 0.9% during the same month, and rising by 2.4% in the three months to January, from a previous 6.5% advance. During the US afternoon, however, BOE's member Kristin Forbes, said that if the economy remains strong and inflation overshoots, a rate hike could come "soon," sending the pair up to 1.2545, a fresh weekly high. From a technical point of view, the 4 hours chart shows that the pair recovered above its 20 SMA, whilst technical indicators have turned surged from oversold readings and are currently entering positive territory with sharp bullish slopes. The pair however, is unable to confirm a clear break of 1.2540 a Fibonacci resistance, with a clear break above it required to confirm further gains up to 1.2705, February monthly high.

Support levels: 1.2470 1.2425 1.2390

Resistance levels: 1.2540 1.2585 1.2630

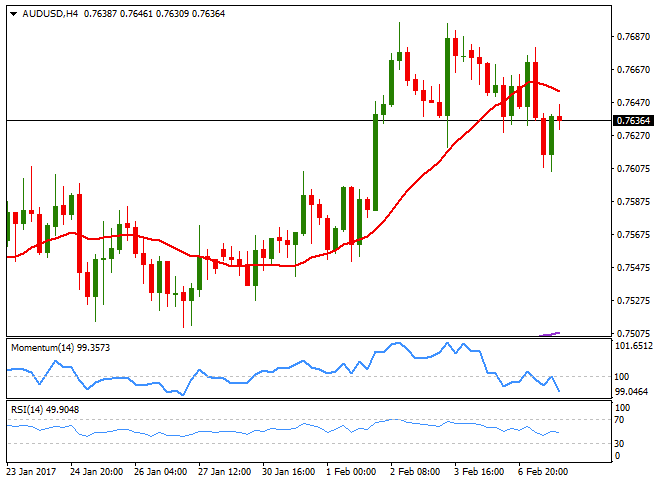

AUD/USD

The AUD/USD pair struggles for direction, ending the day marginally lower around 0.7630 after quite a choppy trading day. The pair rallied early Asia following RBA's decision to leave rates unchanged at record lows of 1.5%. The accompanying statement suggested that policymakers are no willing to cut rates further, as "the board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time." The pair eased with dollar's intraday demand, but quickly bounced after reaching 0.7605, an indication that bulls are in the driver's seat. The 4 hours chart presents a limited upward potential at this point, as the price is unable to establish above a modestly bearish 20 SMA, a few pips above the current level, whilst the Momentum indicator heads south below its 100 level and the RSI indicator consolidates around 49. The US session high was set at 0.7646, with a break above it required to confirm a retest of the 0.7700 region.

Support levels: 0.7630 0.7590 0.7550

Resistance levels: 0.7650 0.7700 0.7735

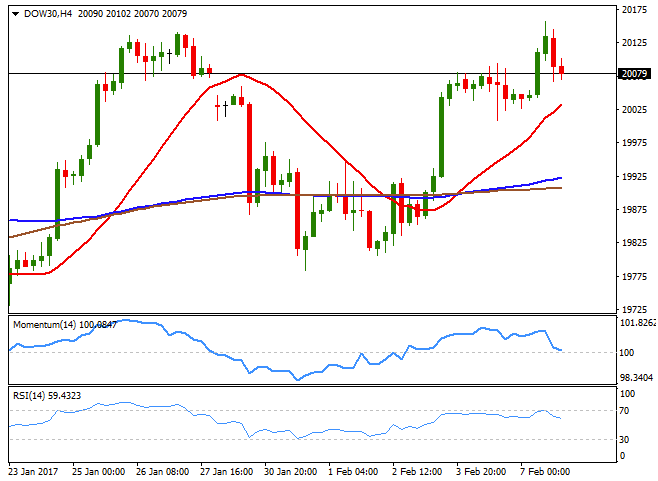

Dow Jones

Wall Street opened the day with strong gains, resulting in the DJIA posting an all-time high of 20,157, but the negative momentum faded and indexes closed barely up around their daily openings. The Dow Jones Industrial Average closed at 20,089.88, up by 0.19%, while the Nasdaq Composite settled at 5,674.22, up 0.19% a record high. The S&P closed flat at 2,293.08 up by 0.02%. Within the Dow, Boeing was the best performer, up by 1.34%, but losers outnumbered gained, with Chevron topping loser's list, down by 1.46%, followed by Merck & Co that lost 1.33%. In the daily chart, the DJIA maintains its positive tone, as it holds well above its 20 DMA, currently horizontal at 19,932, while technical indicators present tepid bullish slopes within positive territory. In the shorter term and according to the 4 hours chart, technical indicators have pulled back from overbought readings reached earlier in the day, but lost downward strength within positive territory, whilst the 20 SMA maintains a sharp bullish slope, currently around 20,033, indicating a limited downward potential, at least as long as buyers defend the 20,000 level.

Support levels: 20,066 20,010 19,932

Resistance levels: 20,104 20,160 20,200

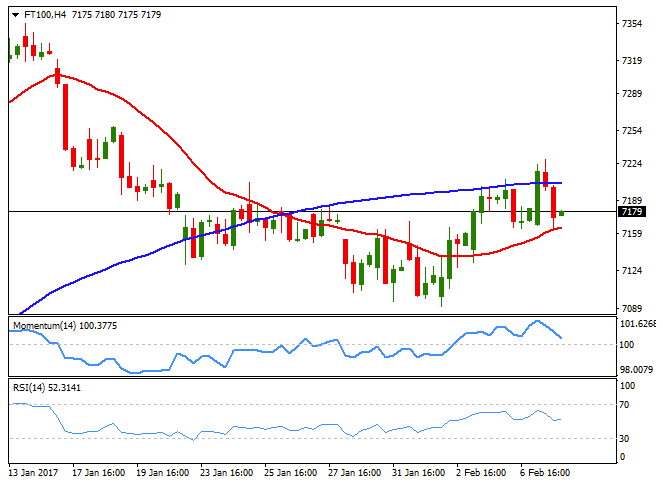

FTSE 100

The FTSE 100 gained 14 points or 0.20% this Tuesday, closing the day at 7,186.22, undermined by the positive momentum of mining-related equities. Gains were offset by oil's decline that resulted in BP leading losers' list with a loss of 4.49%. The best performers were Randgold Resources, up 8.38% and Fresnillo that added 6.60%, as gold hold on to its recent gains. The late recovery in the Pound, will likely dent sentiment among stocks' traders early Wednesday, particularly if the GBP/USD pair holds above the 1.2500 level. From a technical point of view, the daily chart for the Footsie shows that an intraday advance was rejected again by selling interest around the 20 DMA, whilst technical indicators have turned modestly lower around neutral territory, maintaining the risk towards the downside. In the 4 hours chart, the benchmark remains range bound between horizontal moving averages, whilst technical indicators have turned lower within positive territory, now approaching their mid-lines.

Support levels: 7,163 7,128 7,091

Resistance levels: 7,205 7,258 7,312

DAX

European equities closed with modest gains this Tuesday, as sentiment improved for a short time-spam, with the German DAX closing the day at 11,549.44, up by 39 points. Mining and pharmaceutical equities surged, but bank and energy-related ones fell, leading to the neutral close. Vonovia was the best performer in Germany, up 2.09%, while Commerzbank closed 1.21% and Deutsche shed 0.51%. The benchmark recovered from a daily low of 11,463, but the main support is 11,425, January 17th low. In the daily chart, the index remains below a horizontal 20 SMA, now at 11,637, whilst technical indicators present modest downward slopes within neutral territory, indicating a limited upward potential. In the 4 hours chart, the 20 and 100 SMAs converge at 11,623, whilst technical indicators have recovered from near oversold territory, but turned flat within negative territory, in line with the longer term perspective.

Support levels: 11,518 11,463 11,425

Resistance levels: 11,572 11,630 11,680

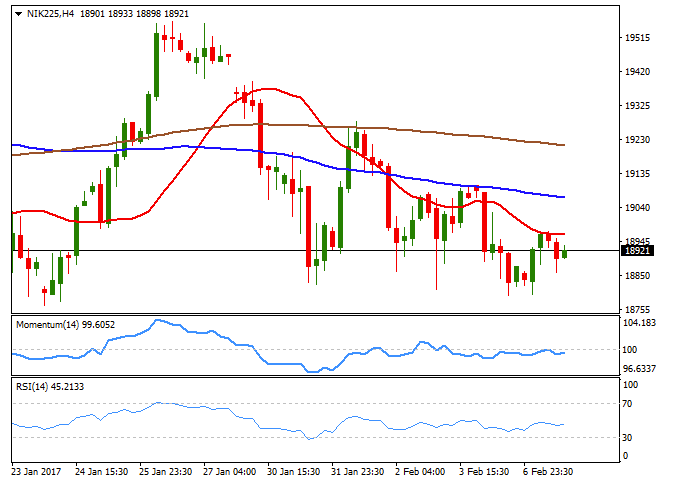

Nikkei

Asian equities' markets closed in the red this Tuesday, with the Japanese Nikkei closing the day down 65 points or 0.35% at 18,910.78, weighed by risk aversion that led the JPY higher against all of its major rivals. Toho Zinc was the best performer, up 5.79%, followed by consumer-oriented Maruha Nichiro that also advanced 5.79%. Financials underperformed, as demand for US Treasuries picked up, and among the biggest losers were Sony Financial Holdings, down 2.61% and T&D Holdings that shed 2.35%. Now poised to open the day just a few pips above the mentioned closed, the technical picture according to the daily chart suggests that further gains are likely to be limited, given that the index continues developing below a bearish 20 DMA, while technical indicators lack directional strength, stuck within neutral territory. In the 4 hours chart, the index also presents a neutral-to-bearish stance, unable to advance beyond its 20 SMA, and with technical indicators heading nowhere right below their mid-lines.

Support levels: 18,793 18,723 18,650

Resistance levels: 18,920 18,984 19,025

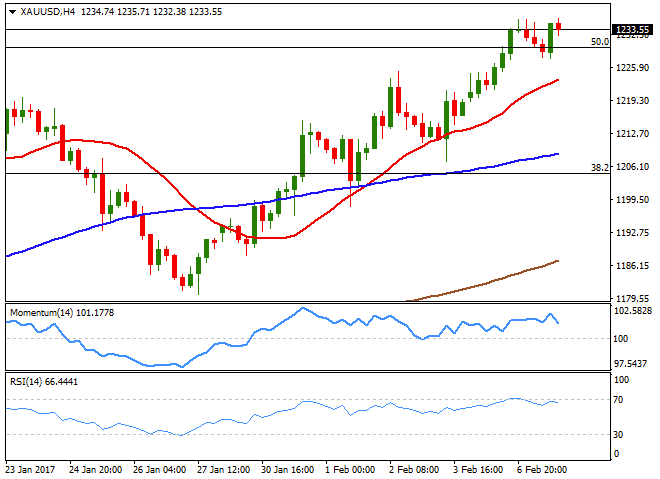

Gold

Gold consolidated its latest gains this Tuesday, setting a fresh high for this 2017 at $1,235.71 a troy ounce. Spot hold within a tight range, just above the 50% retracement of the November/December decline around 1,230.00. The metal was pretty much immune to intraday dollar´s strength, supporting some additional gains ahead. Backing gold's gains was increasing political uncertainty in Europe, adding to that coming from the US. Daily basis, the RSI indicator has lost upward strength within overbought readings, whilst the Momentum indicator diverges lower, nearing its 100 level. The price, however, remains above its 20 and 100 SMAs, with the shortest crossing above the largest, something usually understood as a bullish signal. In the 4 hours chart, technical indicators are retreating modestly from overbought territory, but are far from signaling a bearish extension, whilst the price remains well above bullish moving averages, all of which supports the case for further gains.

Support levels: 1,230.00 1,221.65 1,215.00

Resistance levels: 1,237.30 1,245.20 1,255.05

WTI Crude Oil

Crude oil prices fell for a second consecutive day, as speculators rushed to price in a large US stockpiles build, following a private survey and ahead of the release of official data. West Texas Intermediate US futures fell down to $51.81 a barrel and settled right above 52.00, also weighed by weak gasoline prices on decreasing consumption. WTI fell to the lower end of its latest range, and technical readings in the daily chart support additional declines as the price extended below a flat 20 DMA whilst technical indicators have turned bearish maintaining strong bearish slopes. In the shorter term, the 4 hours chart the 20 SMA turned south well above the current level, with the price also below the 100 and 200 SMAs, both still flat around 53.10, whilst technical indicators have lost their bearish strength, but remain near oversold readings and far from suggesting a bottom has been met. The commodity could extend its decline down to the critical 50.00 region on a break below the mentioned daily low.

Support levels: 51.80 51.10 50.40

Resistance levels: 52.40 53.00 53.65

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.