BlackRock warns on earnings season: Ready?

"We saw 2024 as a year of two stories. First, cooling inflation and solid corporate earnings would support upbeat risk appetite. And later, resurgent inflation would come into view and disrupt sentiment. We stay overweight U.S. stocks yet are ready to pivot. The second leg may be playing out now, reinforcing our expectations for persistently high inflation. That raises the stakes for Q1 corporate earnings to buoy sentiment, in our view, just as higher bond yields add pressure to equity valuations."

This is how analysts at BlackRock describe the current market situation in their weekly commentary.

How to take advantage of your portfolio by taking the advice of experts? Try InvestingPro and find out! Subscribe HERE AND NOW for less than 9 euros per month and get almost 40% off for a limited time on your 1-year plan!

"We’ve expected inflation would be on a rollercoaster as the drag from falling goods prices faded and firm wage growth made services inflation stubborn. Yet the March pick up in core services inflation shows that inflation is proving sticky," the report explains.

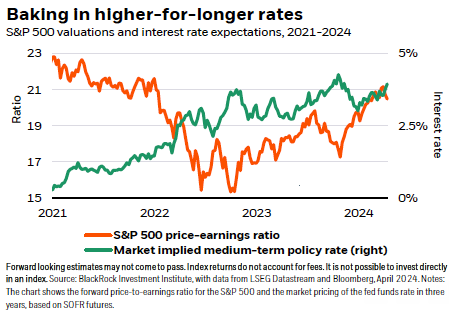

"Further escalation of Middle East tensions could see oil prices staying elevated reinforcing higher inflation and higher for longer interest rates. Sticky inflation has prompted markets to slash their expectations for Federal Reserve rate cuts to less than two this year ( green line in chart) in line with our view," they add.

BlackRock (NYSE:BLK)

According to comments from BlackRock, "The Fed has gone from blessing market hopes for inflation to fall to 2% without a growth hit to implying policy may have to stay tight. The S&P 500 price to earnings ratio a popular valuation metric shows stocks feeling the heat from higher rates (orange line). We think that’s why it’s more crucial that companies keep meeting or beating high earnings forecasts."

"We question whether the slide in stocks is a blip or a bigger shift toward pricing in inflation and interest rates settling higher than pre pandemic. We stay overweight U.S. stocks on a six to 12 month tactical horizon but are ready to pivot given that uncertainty," these experts emphasize.

"We have broadened out our stock view to include segments of the market with an improving earnings growth outlook. And we have leaned against small cap stocks whose earnings are at greater risk from higher rates. Earnings face a critical test this week with some mega cap tech companies reporting. With stocks under pressure and rate cut hopes fading, we think the bar is higher for tech firms to deliver on earnings expectations and for other sectors to show an earnings recovery. Confirmation of inflation settling higher and earnings misses could trigger a change to our view," they add.

Bet on AI

"We still prefer artificial intelligence (AI) beneficiaries to tap into the AI and digital disruption mega force a structural shift driving returns now and in the future,” say the analysts. "We went overweight early AI winners and enablers like chip and hardware makers in 2023," they add.

"That view paid off as some valuations soared above historical averages. We are eyeing potential winners further up the technology stack the layers of technology needed to develop AI applications and beyond as AI adoption spreads," says BlackRock.

"That’s the case in healthcare, financials and communication services, sectors we like because they have more scope for productivity gains. Outside of tech, those sectors have had some of the most mentions of AI related keywords in earnings calls and company filings, BlackRock’s Systematic Equity team finds. AI mentions in non tech sectors have soared 250% since 2022," they add.

"Bottom line: U.S. earnings updates this week will be key to see if they can keep topping expectations and buoying risk appetite in a higher for longer interest rate environment. We’re overweight U.S. stocks and see the AI theme broadening," the analysts caution.

How to know where to invest to keep making money? When and how to enter or exit? Seize the opportunity HERE AND NOW to get the annual plan of InvestingPro at a discount. Use the code INVESTINGPRO1 and get up to 40% off your 1-year subscription. Less than the cost of a Netflix subscription! (And more rewarding!). With it you will get:

- ProPicks: portfolios of stocks managed by AI with demonstrated performance.

- ProTips: digestible information to simplify complex financial data in a few words.

- Advanced stock finder: Search for the best stocks according to your expectations, considering hundreds of financial metrics.

- Historical financial data of thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to incorporate in the near future.

Act fast and join the investment revolution! Get your OFFER HERE!

Begin trading today! Create an account by completing our form

Privacy Notice

At One Financial Markets we are committed to safeguarding your privacy.

Please see our Privacy Policy for details about what information is collected from you and why it is collected. We do not sell your information or use it other than as described in the Policy.

Please note that it is in our legitimate business interest to send you certain marketing emails from time to time. However, if you would prefer not to receive these you can opt-out by ticking the box below.

Alternatively, you can use the unsubscribe link at the bottom of the Demo account confirmation email or any subsequent emails we send.

By completing the form and downloading the platform you agree with the use of your personal information as detailed in the Policy.