- Markets

Find out what influences market movements by browsing through our tailor made product pages.

- Trading Platforms

Maximise your investment opportunities

Trading Platforms

In order to ensure our customers have the best trading experience. We are proud to introduce our suite of trading platforms.

- Accounts

All accounts can be opened using one application form.

OPEN A LIVE ACCOUNT

The application process is simple and straightforward. You can complete the online application form and be trading in minutes.

- Academy

Here you will find all the details regarding One Financial Markets educational offering

TRADING ACADEMY

Working through each of our six online modules, detailed below, you can develop your trading confidence

- Newsroom

The latest news in the Financial Markets from across the globe.

LATEST NEWS

Make sure you don't miss out on what's going on in the world around you, keep up to date with our market commentary and daily market update videos.

- Contact Us

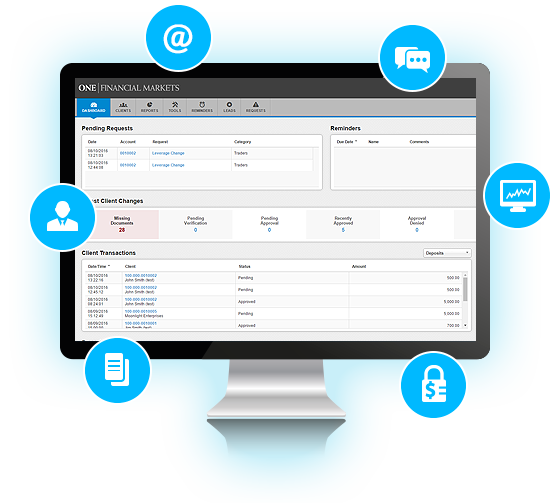

Welcome to One Financial Markets' Client Portal

Our Client Portal is designed exclusively to improve the service we offer and to assist with the day to day management of your account.

It is an easy-to-use personal account management portal where you are able to deposit, transfer or withdraw funds, open additional trading accounts, manage your personal details and more...

Key features:

- View the status of your account application

- Upload documents

- Deposit, withdraw, convert or transfer your funds quickly and easily

- View your recent trading activities

- Manage your live and demo accounts in one place

- Change your personal or security details

- Control your communication preferences

- Request a change in leverage

If you are based in the Middle East please login here

Please use your email address and the password you chose in your application form. If you have any trouble logging in please click on the ‘Forgot Password’ link to reset your password or contact our support team at clientservices@ofmarkets.com

Our client portal is an easy to use personal account management tool that allows you to: view the status of your application, manage your demo and live accounts, upload documents, deposit, transfer or withdraw funds, request additional trading accounts, manage your personal details, control your communications preferences and more.

How do I log in to the portal?

In order to login to your client portal please click here to get to the login page.

Your username and the password are the email address and password provided in your application form.

Click on ‘login’ button to access your portal.

What is a ‘Landing Account’ and how does it work?

Your landing account acts as a wallet that is independent of your trading account(s) and is where withdrawals are made from. It is important to be aware that money in a landing account is not included in your trading account balance and is therefore not treated as margin.

If you make an online deposit from within the portal you can choose to add funds to your landing account or directly to your trading account. Deposits made outside of the portal, i.e., bank transfers or online payments initiated via links on our website(s) will be added to your landing account and you will need to transfer funds to your trading account.

If you select ‘USD’ as the base currency for your trading account at the time of registration, you will be set up with a USD landing account and should you wish to have a trading account in a different currency, we shall set you up with a different currency landing account.

Please note that your trading account will be linked to the associated landing accounts based on the currency you select i.e., there will be one landing account per currency.

We currently offer trading accounts in three currencies USD, GBP and EUR.

Please contact our Client Services Team if you have any questions or for more information.

How do I transfer funds between accounts?

Click on the “Transfers” tab on the top of your screen and then on the “Internal Transfer” tab on the right hand side to select the “From Account”, “To Account” and “Amount”. Click “Submit” to confirm the transfer and you will see the transfer confirmation message that funds have been moved. You can check your account balance(s) by navigating to the ‘My Accounts’ tab.

Can I transfer funds between my landing accounts?

Yes. Click on the ‘Transfers’ tab at the top of your screen, select the applicable landing accounts in the ‘From Account’ and the ‘To Account’ drop down options, enter the amount you wish to transfer in the ‘Amount’ field and click “submit”. As you are making a transfer between different currency landing accounts, the exchange rate will be automatically calculated via an inbuilt calculator using current market prices. If you are happy with the rate please click “submit”. You will then see the transfer confirmation message and funds will have been moved. You can check your account balance(s) by navigating to the ‘My Accounts’ tab.

Can I access Web Trader from the portal?

Yes. You can now access our Web Trader directly within your client portal. You will no longer need to navigate away to our website or email to access the link. Simply click on the link in the top menu bar, select your account number and start trading!

Please click on ‘Forgot Password’ link on the login page in order to reset your password or contact our support team at clientservices@ofmarkets.com for assistance.

Your portal allows you to save different ‘Funding Sources’ for your trading accounts. In order to improve the efficiency of fund withdrawal payments, please update your bank details in this section. Click “add new funding source” and complete the applicable fields.

What information can I view on the dashboard?

Your dashboard shows all recent activities, i.e., payments, internal transfers and withdrawals, as well as Market Hours and other important information. You can also view your account equity details in the ‘Account Overview’ window.

Furthermore, the Market News window shows latest notifications with regards to financial market updates, financial instruments in focus, any new events and their impact on the Markets.

I’ve forgotten my MT4 (trading) account login details and can’t log in

In order to change your trading account password, please go to the ‘My Accounts’ tab at the top of your screen and select the relevant trading account.

For any technical issues with your client portal or trading platform please contact our support team at clientservices@ofmarkets.com or call us on + 44 ( 0 ) 203 857 2000.

How do I update my contact details?

You can go to the ‘Profile’ tab as shown in the picture below: Click on ‘Edit’ option in order to update your contact details

What languages is it available in and how can I change my language preference?

Our client portal is available in a selection of different languages for your ease and convenience. Please click on the ‘Profile’ tab at the top right of your screen and choose your preferred language from the drop down options.

Can I provide my supporting documents via the portal?

Yes. You are now able to upload supporting documents straight to your portal so our KYC team can review them. Upload documents via the ‘Documents’ tab at the top of your screen. In this tab you will see two document upload links under ‘My Documents’ heading. Click on the grey arrows below the ‘Actions’ heading and upload your documents.

Note: Please note that acceptable file types are: jpg, gif, png or pdf. Maximum size of file that can be uploaded is 3.3MB.

For more information about our supporting document requirements please click below.

Where can I find my account statements?

You can also download instant quick reports designed to facilitate account management for any time period by selecting the required date from the provided calendar options. You can download the following types of account reports through the quick report tool:

•Summary report

•Deposit/ Withdrawal

•Account statement

You can manage your email settings in the ‘Email Notification Preferences’ option at the bottom of the ‘Profile’ tab window:

Note: We have a regulatory duty to provide you with account statements so please be aware that it may not be possible to unsubscribe from e-statements.

How secure is my Client Portal?

Our new client portal is designed to enable our clients to manage all their personal and trading account details in a secure environment. Your password is unique and is not provided to any third party.

The portal allows you to modify your account preferences and all activity and updates including recent transfers and fund withdrawals can be tracked by looking at your ‘Recent Activity’ window in the Dashboard.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.