The Basic Guide to Using an Economic Calendar

5th April 2019

Following the news is an important part of trading. While the strategy you are using might not incorporate economic news or monetary policy data, keeping track of what is happening could be the difference between a successful and unsuccessful strategy. If you believe that all the available information is incorporated into the price of an asset, then new information is key to determining the future price of that asset.

One of the most efficient ways to keep track of new information is by using an economic calendar. An economic calendar is a date calendar that displays the economic data that is scheduled to be released. The data on your broker's economic calendar might be displayed in a unique way, but the underlying information should basically be the same across all calendars. Your broker's calendar might cover just the major developed nations, or it might be broad enough to incorporate emerging countries from around the globe. The economic calendar used in this article can be found on One Financial Markets.

The Layout of an Economic Calendar

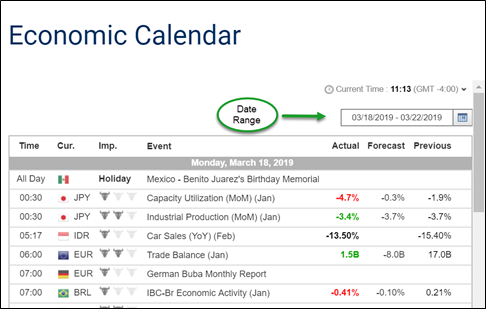

The layout of an economic calendar should be straight forward and easy to navigate. You should have access to a date range which will allow you to see any dates you want in the future as well as what has occurred in the past. A convenient setting is one where you can see the information that is scheduled to be released today, and what is expected to be released over the next week. Having a date range provides a lot of flexibility especially if you missed an important release and want to quickly see what occurred.

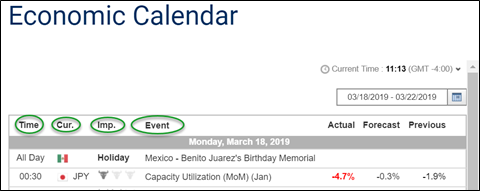

The information should be laid out in a way where you can quickly grasp what has occurred and when. You should easily be able to see the future time (Time) of the release along with the currency (Cur.) that will be affected. Your broker also might provide a scale that describes what type of impact (Imp.) the release will have on the market. For example, an impression of one bull might describe a release that has a small impact, while three bulls would indicate a major impact. The event itself should also be visible.

Additionally, having access to the actual release, the forecast, and the previous release will put everything in context.

Your broker's economic calendars might incorporate speeches that are scheduled by officials as well as monetary policy announcements. While a speech does not reveal a specific number, knowing the time of the speech will provide you with a key alert especially if something is said that is market moving.

How to Interpret Information on an Economic Calendar

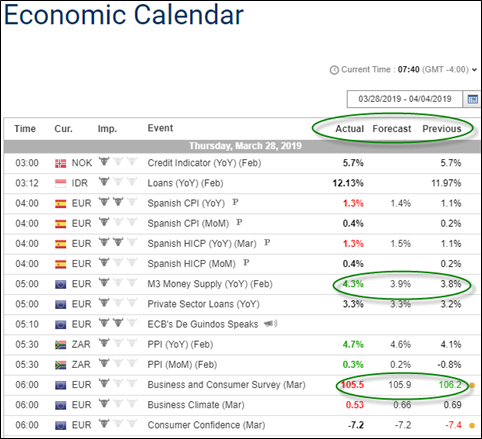

Each data point reveals a new piece of news which is quickly incorporated into the price of an asset. Prior to the release, there are several pieces of information that are already known. You already know what happened in the prior month (or release), as well as the forecast of the coming release. You can assume that the current forecast of an economic release is incorporated into the price of an asset. New data will be what is actually released, and that is what traders generally use to determine if the price of an asset is undervalued or overvalued.

For example, if the average analyst forecast for the US Jobs report shows an increase of 200,000 jobs are expected, and the release actually displays that only 25,000 where created, traders could interpret this as economic weakness. When economic weakness that was not expected is revealed, yields usually decline along with the value of a currency.

If the new economic data comes out as expected, you might expect the market to remain steady. It’s helpful to have a real-time economic calendar that reflects the data instantaneously. This will allow you to either initiate a trade or manage your risk in real time.

How Can You Trade Around Economic Data?

The capital markets can be volatile after an economic release especially if the data is expected to have a high impact and the release was different from expectations. The price of an asset or an exchange rate can gap up or down following a release, and you should expect volatility. You will find that the bid-offer spread ahead of a release will generally widen, and immediately following a release you might not be able to get a firm price. Generally, the markets settle in within minutes of a release.

The safest way to trade economic data is to wait and see what actually happens before you make a decision. If you have a position on ahead of a release, be cognizant that you could experience whipsaw price action. Once the economic data is released, evaluate what has occurred relative to expectations. You will then be able to make an informed decision.

All content is provided for your information only.

This article may contain opinions and is not advice or a recommendation to buy, sell or hold any investment. No representation or warranty is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. Non-independent research is not subject to FCA rules prohibiting dealing ahead of research, however we have put controls in place (including dealing restrictions, physical and information barriers) to manage potential conflicts of interest presented by such dealing.

One Financial Markets expressly disclaims all liability from actions or transactions arising out of the usage of this content. By using our services, you expressly agree to hold One Financial Markets harmless against any claims whatsoever and confirm that your actions are at your sole discretion and risk.

Begin trading today! Create an account by completing our form

Privacy Notice

At One Financial Markets we are committed to safeguarding your privacy.

Please see our Privacy Policy for details about what information is collected from you and why it is collected. We do not sell your information or use it other than as described in the Policy.

Please note that it is in our legitimate business interest to send you certain marketing emails from time to time. However, if you would prefer not to receive these you can opt-out by ticking the box below.

Alternatively, you can use the unsubscribe link at the bottom of the Demo account confirmation email or any subsequent emails we send.

By completing the form and downloading the platform you agree with the use of your personal information as detailed in the Policy.