How to Start Trading Gold Bullion

23rd April 2019

Gold trading has been around for centuries. It was one of the first global currencies allowing merchants to exchange good and services. The gold market offers a product that has excellent liquidity and opportunities to profit in nearly all climates due to its unique position within the world’s economic and geopolitical environments. In this article, you will learn how to trade gold.

There are several ways to trade gold:

- You can purchase physical bullion or coins

- You can buy and sell futures

- You can invest in exchange-traded funds

- You can trade contracts for differences

Many traders fail to take advantage of price fluctuations in gold because they do not fully understand why it moves. Trading gold is not difficult, and the learning curve is relatively flat. There are several gold trading strategies that you can use to help you determine the future direction of gold prices.

Gold is Viewed as a Currency

When you think about trading in gold, you can equate it to currency trading. While gold is technically a commodity, categorized as a precious metal, it in fact trades like a currency. Like most commodities, the supply of the product and the demand drive the price over the long term. Short-term fluctuations are driven by sentiment.

Gold is quoted in US dollars and its characteristics on a global stage, provide traits that make it appear to be a currency. Gold is held in reserves by central banks, along with dollars which provide a benchmark for their liquidity.

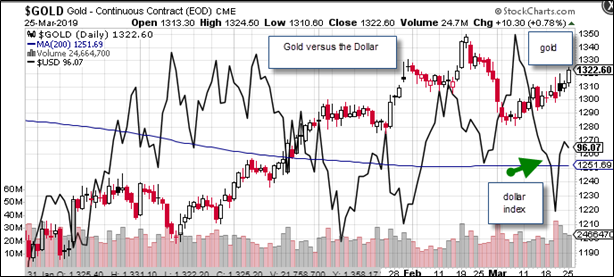

Since the gold trading price is quoted in US dollars, as the dollar rises in value, gold becomes more expensive in other currencies. You can see from the chart of gold versus the US dollar index below that, generally, as the dollar declines gold prices rise and vice versa. Additionally, gold is seen as a safe haven currency, which you would buy if you believed a devaluation of other currencies was imminent.

How to Execute Gold Trades

There are several ways to buy and sell gold. If you want to hold gold for the long term, you might consider purchasing bullion or coins. If you are considering trading in gold bullion, this investing style is too expensive because commissions on physical bullion are elevated.

If you have a futures account, this method is attractive. Futures are liquid and also provide leverage. Futures are set in specific contract sizes which might not fit your investment budget.

If you trade equities, there are exchange-traded fund products that focus on gold. These are liquid products that are actively traded. The downside is that there is very little leverage available on these products.

The CFD market is very liquid and has several benefits. The bid offer spread is tight, allowing you to enter and exit at a low expense rate. There is a product margin available up to 20:1. You can also trade CFDs in multiple currencies. For example, gold versus the Euro. CFDs are generally liquid around the clock providing several opportunities to make money.

Gold Trading Strategies

Gold can be traded using fundamental analysis, technical analysis, or a combination of both. The fundamental analysis that you employ should be based on your view of the dollar as well as how prices are reacting around the globe. Gold is often seen as an inflation gauge. If the value of hard assets is climbing, then the price of gold will rise in tandem with global inflation. To follow economic developments and the gold trading price, you can keep up with an economic calendar. Here you will see actual versus forecasted economic events from around the globe. Your fundamental view should guide your longer-term view of the price of gold and the dollar.

Technical Analysis

You can use sentiment and technical analysis to develop short-term trading strategies. Gold will trend, as momentum accelerates, and will trade sideways in a mean-reverting pattern.

- Trend following is a strategy where you attempt to pinpoint a trend. A moving average crossover strategy is a good strategy to pinpoint short- and long-term trends. Using different moving average lengths to find the trend period that works for you.

- Accelerating positive and negative momentum usually, precede a trend. You can use the MACD (moving average convergence divergence) index to capture momentum. This is also a crossover strategy.

- You can use an oscillator such as the relative strength index (RSI) or fast stochastics to determine if prices are overbought or oversold.

- You can use Bollinger bands to evaluate if gold is rangebound and poised to mean revert.

If you are new to trading, it is highly recommended that you spend time working through One Financial Market’s Trading Academy so that you can develop your gold trading skills.

Summary

Gold is a commodity that trades like a currency. Gold trading is liquid and trades around the clock in locations throughout the globe. You can purchase physical gold, but if you plan to trade multiple transactions you are better served trading CFDs, futures or exchange-traded funds. The fundamentals of gold are driven by the value of the dollar, geopolitics, and inflation. You can enhance your fundamental view with technical analysis. One Financial Markets offers gold trading online through its comprehensive trading platform.

All content is provided for your information only.

This article may contain opinions and is not advice or a recommendation to buy, sell or hold any investment. No representation or warranty is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. Non-independent research is not subject to FCA rules prohibiting dealing ahead of research, however we have put controls in place (including dealing restrictions, physical and information barriers) to manage potential conflicts of interest presented by such dealing.

One Financial Markets expressly disclaims all liability from actions or transactions arising out of the usage of this content. By using our services, you expressly agree to hold One Financial Markets harmless against any claims whatsoever and confirm that your actions are at your sole discretion and risk.

Begin trading today! Create an account by completing our form

Privacy Notice

At One Financial Markets we are committed to safeguarding your privacy.

Please see our Privacy Policy for details about what information is collected from you and why it is collected. We do not sell your information or use it other than as described in the Policy.

Please note that it is in our legitimate business interest to send you certain marketing emails from time to time. However, if you would prefer not to receive these you can opt-out by ticking the box below.

Alternatively, you can use the unsubscribe link at the bottom of the Demo account confirmation email or any subsequent emails we send.

By completing the form and downloading the platform you agree with the use of your personal information as detailed in the Policy.