Market Commentary - 05th April 2018

6th April 2018

Indices

DOW30 +0.99%, S&P500 +0.69%, NASDAQ +0.49%, DAX30 +2.90%, FTSE100 +2.35%, NIKKEI225 +1.53%

Equity markets carried on where they left off on Wednesday with all global indices posting impressive gains – European equites, in particular, playing catch up with the US market posted some of the best gains YTD. In the US, the DOW30 rose 240.92 points to close at 24,505.22 for a gain of 0.99%. The S&P500 and Nasdaq climbed 0.69% and 0.49%, respectively.

Facebook gained 2.70% after CEO Mark Zuckerberg noted he has not seen a noticeable change in user behaviour since the Cambridge Analytica data scandal was unearthed.

In economic data, initial jobless claims climbed to 242,000 in the week ending 31st March – this was larger than the 225,000 expected by the market. The release of the monthly employment report is due Friday with jobs growth expected at 198,000 in March. The unemployment rate is expected to drop to 4% from 4.1%.

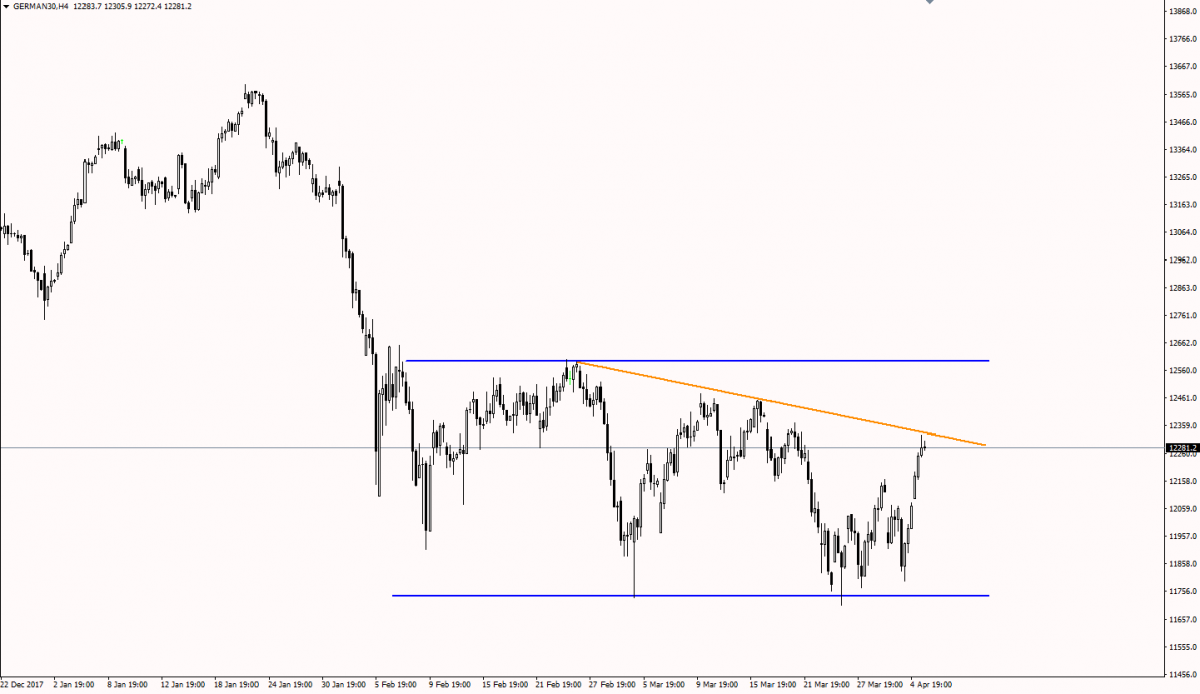

DAX in 800-point range but gains today capped by the descending trend line at 12,330

FX

EURUSD -0.31%, GBPUSD -0.54%, USDJPY +0.57%, AUDUSD -0.41%, EURGBP +0.22%, USDCAD -0.16%

The USD index traded at it’s highest level in nearly a month as equity markets continued on their upward trajectory and fears of a trade conflict between the US and China subsided on hopes of negotiations breaking out instead of a trade war.

Comments made by White House economic adviser Larry Kudlow calmed investor fears on Thursday. Ludlow commented that he expects the United States and China to work out their trade differences and that trade barriers likely "will come down on both sides." His comments sent the USD higher but his sentiments have not been matched by similar rhetoric from China. The nation's state news agency, Xinhua, said that China will win any trade war with the United States.

The USD climbed to two week high against the Euro, closing at 1.2240. In Eurozone economic data, producer price inflation held steady in February, climbing 1.6% YoY in February, the same rate of increase as in January. Retail sales increased at a slower than expected pace in February with growth of just 0.1%.

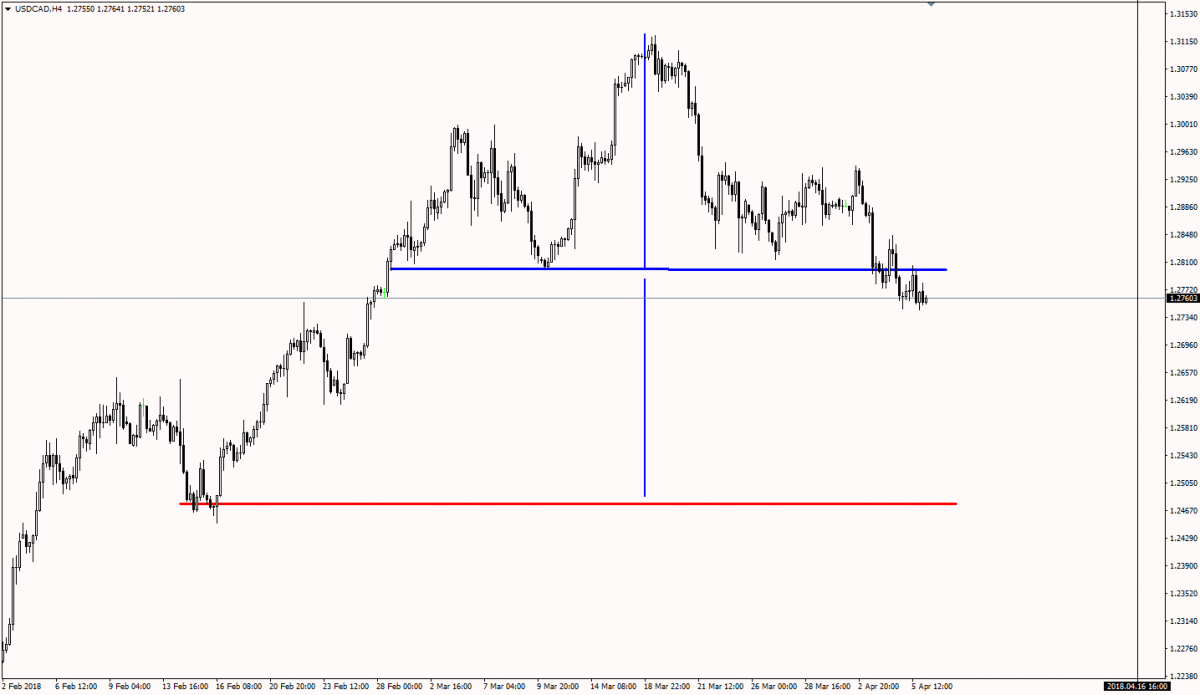

USDCAD continues to slide post ‘Head & Shoulders’ break. Target 1.2475

Commodities

XAUUSD -0.50%, XAGUSD +0.75%, WTI Crude +0.57%, Brent Oil +0.72%

Oil prices gained on Wednesday supported by rising equity markets as trade tensions between China and the US softened. A stronger dollar, trading at near one month highs, capped gains.

Oil continues to be range bound, however, amid conflicting reports about OPEC's supply quota plans. On Tuesday, a Russian official said that it wants to extend its supply quota plan with OPEC beyond 2018. However, other reports say Russian production may be rising as the government does not want to lose market share.

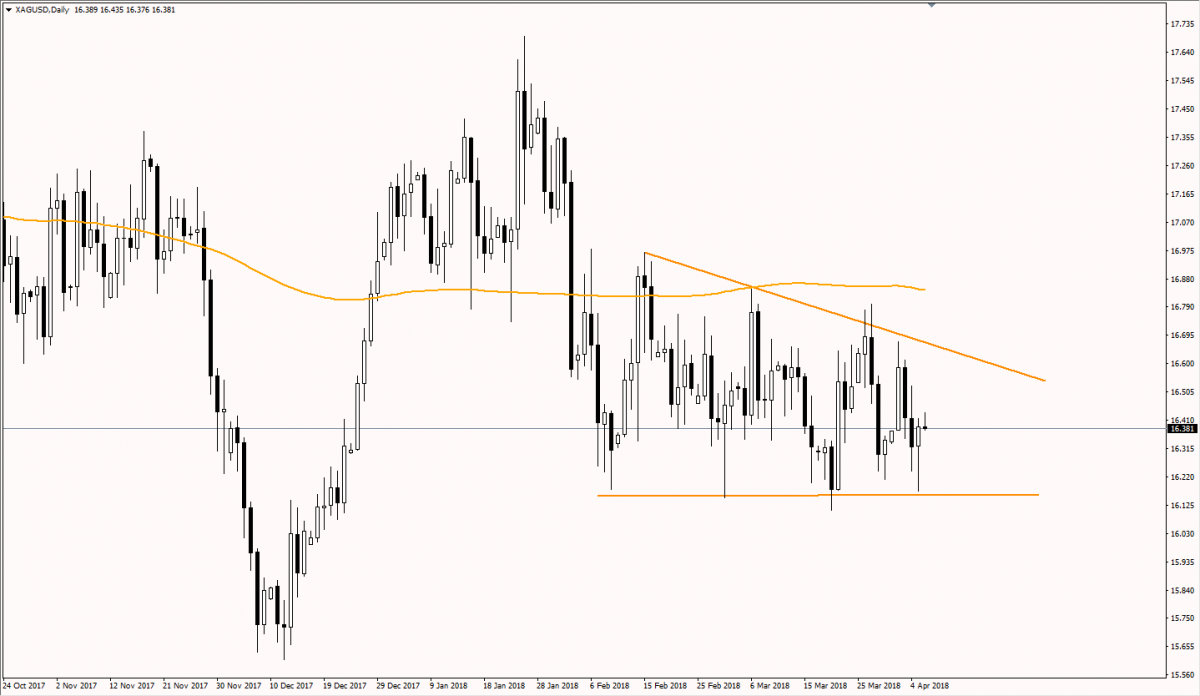

XAGUSD trading in a bearish descending triangle. S = 16.150, R = 16.650

Begin trading today! Create an account by completing our form

Privacy Notice

At One Financial Markets we are committed to safeguarding your privacy.

Please see our Privacy Policy for details about what information is collected from you and why it is collected. We do not sell your information or use it other than as described in the Policy.

Please note that it is in our legitimate business interest to send you certain marketing emails from time to time. However, if you would prefer not to receive these you can opt-out by ticking the box below.

Alternatively, you can use the unsubscribe link at the bottom of the Demo account confirmation email or any subsequent emails we send.

By completing the form and downloading the platform you agree with the use of your personal information as detailed in the Policy.