How to trade today in the most tense and volatile 'quadruple witching hour' of the year

By Laura Sanchez

Investing.com - Markets are in the red as exhibited by the Ibex 35, CAC 40 and DAX, after this week's slam dunk from central banks. "Investors face a complex session, which will see the quarterly expiration of stock and index futures and options contracts, known as quadruple expiration of derivatives or quadruple witching hour," Link Securities explain in their daily report.

This event occurs on the third Friday of March, June, September and December each year. "Normally this milestone distorts the behavior of the spot markets, raising volatility in them, which makes it very complicated to draw conclusions about their real state," the analysts added.

Although the markets are still in the red as the session progresses, Link Securities does not rule out that, as the session progresses, they may turn around. "This will depend to a large extent on the performance of Wall Street, a market whose behavior will set the pace for the rest of the Western stock markets".

Meanwhile, Ben Laidler, global markets strategist at eToro, warns that today's witching hour "could worsen an already volatile week for markets."

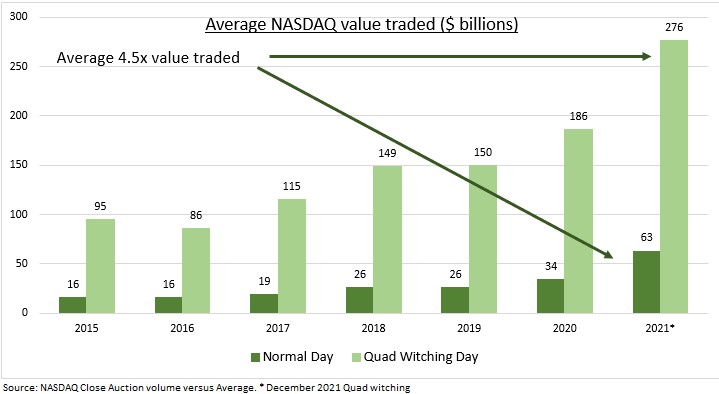

"Today is one of the highest market volume days of the year. U.S. futures and options (F&O) expiration generates volumes nearly five times normal levels (see chart). Volume is even higher due to increased options activity in recent years, driven by retail trading, and major stock indices also rebalancing on the same day."

Chart provided by eToro

"It could worsen an already busy and volatile week, with macroeconomic data and central bank meetings, and comes ahead of the Christmas vacation, characterized by very low trading volumes. There is evidence that the witching hour can increase short-term volatility and reduce returns next week, but with little lasting impact on the market," adds Laidler.

"Futures and options activity soared in recent years, and this has continued into 2022. The volume of options traded on the U.S. exchange has increased by 26% comparing the value traded in September to December 2021. Similarly, futures volume is up 20%, according to the BIS. Much of this rise is due to an increase in retail investors, who show no signs of pulling out of the markets despite the recent weakness. There is little sign of the witching hour driving markets lower on the day itself, but it may lead to some moderate weakness in the week ahead," concludes eToro's market strategist.

"The most important thing is to manage stop losses well to avoid large losses if the market suddenly turns the other way. Typically, the market usually rises just before expiration and sells off just after," highlights Admiral Markets in an analysis published on its website.

"This situation can provide us with short-term buying opportunities, as long as we watch for sell signals before the market turns around," the experts conclude.

Begin trading today! Create an account by completing our form

Privacy Notice

At One Financial Markets we are committed to safeguarding your privacy.

Please see our Privacy Policy for details about what information is collected from you and why it is collected. We do not sell your information or use it other than as described in the Policy.

Please note that it is in our legitimate business interest to send you certain marketing emails from time to time. However, if you would prefer not to receive these you can opt-out by ticking the box below.

Alternatively, you can use the unsubscribe link at the bottom of the Demo account confirmation email or any subsequent emails we send.

By completing the form and downloading the platform you agree with the use of your personal information as detailed in the Policy.