This tool will dramatically improve your earnings season game - For free

Investing.com — As big tech earnings continue to disappoint, with another miss from Microsoft (NASDAQ:MSFT) last evening, several investors are beginning to think this might be an overall bearish earnings season.

Nothing could be further from the truth, though.

As a matter of fact, more than 78% of S&P 500 companies that have reported so far have posted earnings beats to date.

Furthermore, as the positive EPS trend continues to gain momentum, more companies have outperformed their earnings expectations for the Jun-2024 quarter than in any of the previous four quarters.

So, if you are not making money this earnings season, don’t blame the companies reporting. The fact is you just haven’t been positioned in the right stocks.

But here’s the good news: Investing.com has just launched a new free screener that will help you find best-in-breed stocks within minutes, helping you beat the market with more accurate decision-making.

The second good news of this article is that our new screener is not just free, but it also offers a seamless user experience, with several predesigned screeners helping you fetch your desired results at the click of a button.

Users who signed up early are already fetching excellent picks from several of our screeners, such as:

- Stocks Under $10 a share - which gives you the best wallet-friendly buys out there.

-

High Beta Bulls - which provides users with the stocks poised to make the biggest upside moves in the market.

- Consistent Earnings Growers - Which identifies companies with a track record of consistent EPS growth for sustained outperformance.

Just to name a few! Subscribe here for free and start using it now.

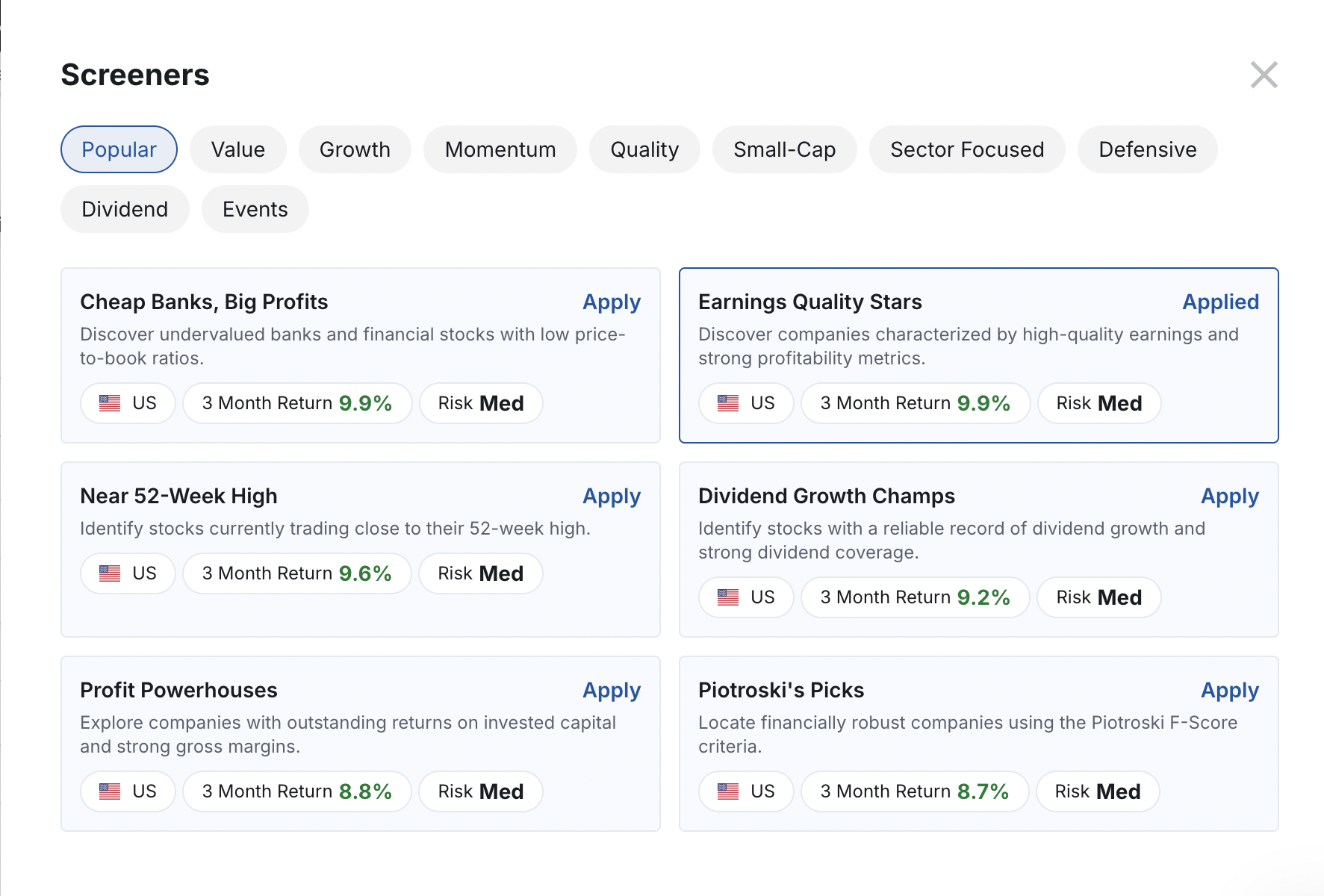

Today, however, I’ll talk a little more about another very relevant predesigned screener - our flagship Earnings Quality Stars screener.

As the name implies, this screener will help you find the best stocks that have a high likelihood of reporting positive earnings ahead.

Here's how to do it in four easy steps:

Step 1: Register for Free on Investing.com

To get started, you'll need to register for a free account on Investing.com. Simply visit the Investing.com website, click on the "Sign Up" button at the top right corner, and fill in your details.

Once you've registered, you'll have access to the full range of features, including the stock screener.

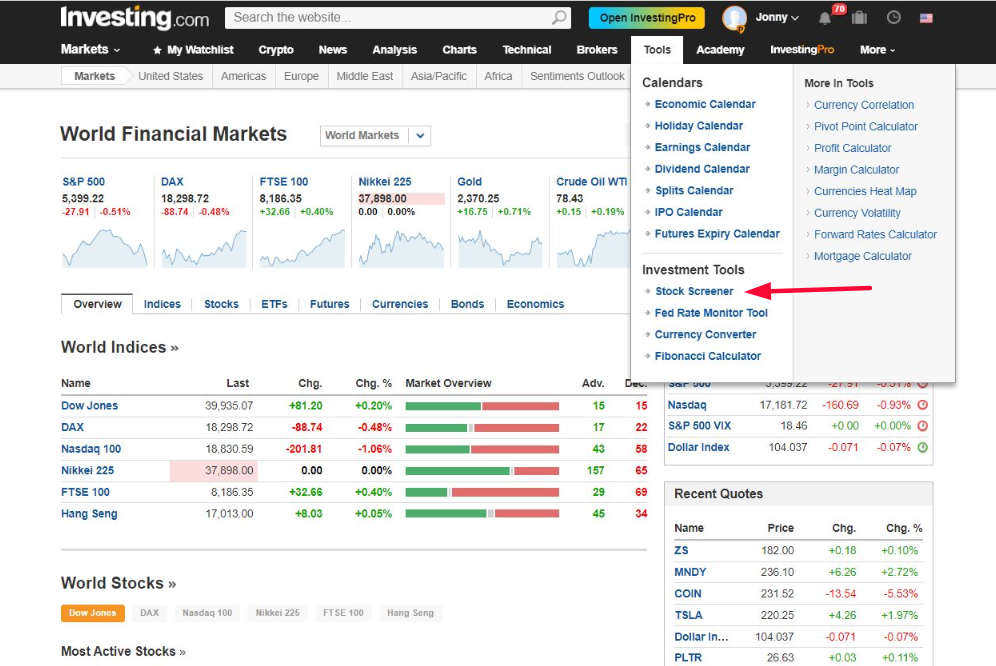

Step 2: Access the Stock Screener

After logging in, navigate to the "Tools" section in the main menu and select "Stock Screener."

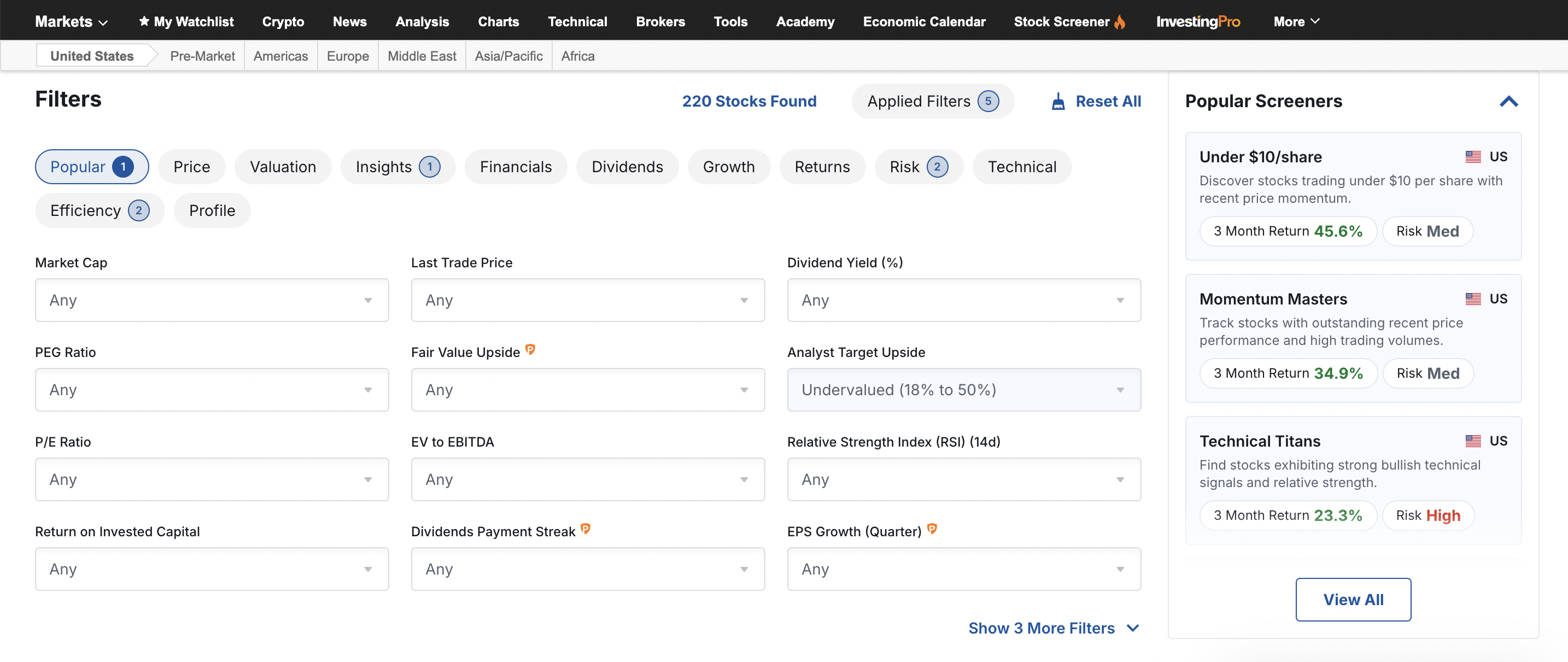

Step 3: Find the Predesigned Screener List

Once in the article, find the Popular Screeners menu on the righthand side and click on "view all."

Step 4: Applying the Predesigned Screener

Next step is finding the Earnings Quality Stars screener on that list and clicking on it to activate it.

Voilà! This will automatically take you to a list of stocks with great earnings potential.

See below:

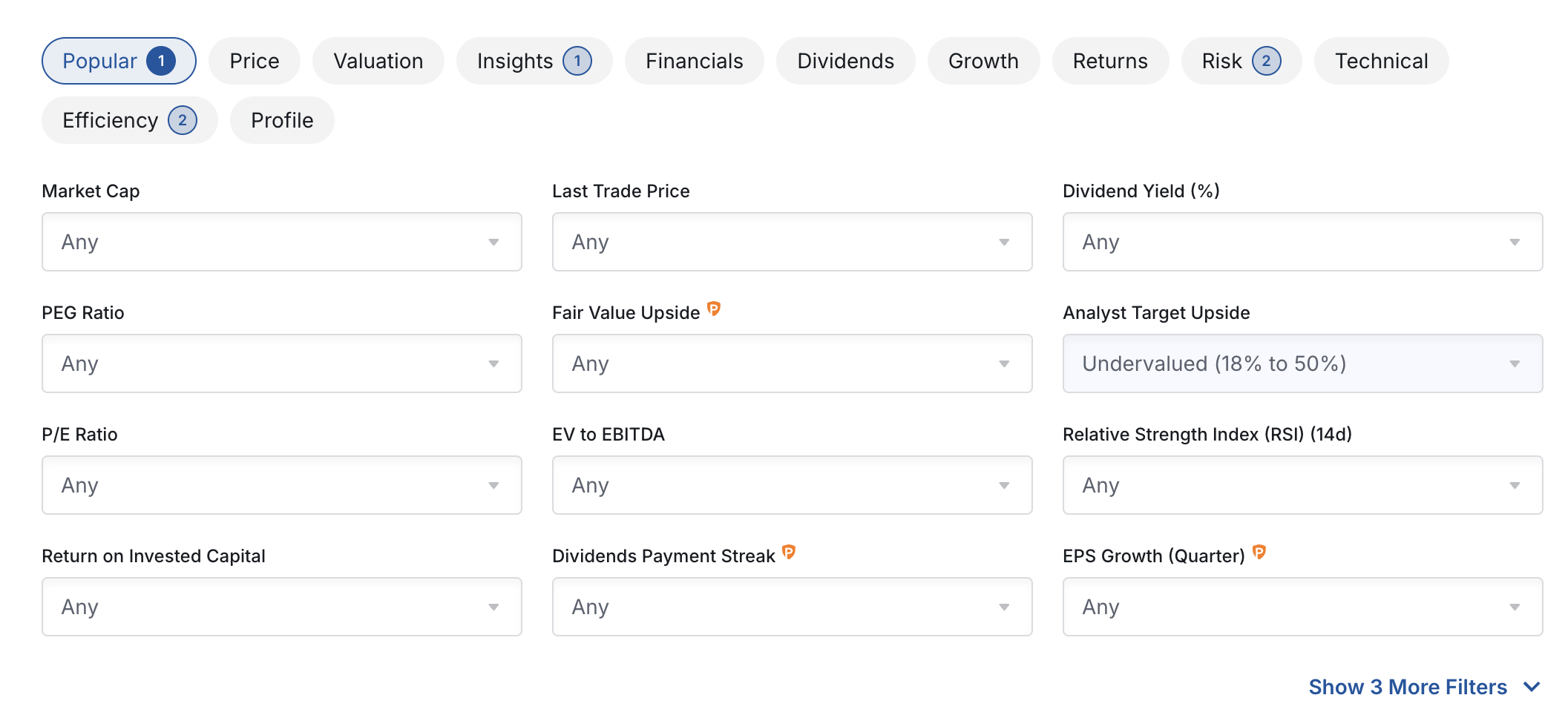

Bonus Step: Adding Your Own Spin to It

Still want to refine the view you got from the predesigned screener?

Simple - just add any of the several metrics available.

For the current purpose, I suggest adding "Undervalued: 18% to 50%" for a more refined view of only undervalued stocks with positive earnings trends.

Click here to jump to the results from this search!

So, what are you waiting for?

The Investing.com stock screener is a powerful tool that can help you identify stocks with strong technical setups, making your investment decisions easier and more informed.

By registering for free on Investing.com, you can unlock the full potential of this tool and take your stock market investing to the next level.

Start using the Investing.com stock screener today and discover the power of smart stock selection!

*To ensure the best possible user experience with the new screener, make sure to log in to Investing.com on all your devices.

Begin trading today! Create an account by completing our form

Privacy Notice

At One Financial Markets we are committed to safeguarding your privacy.

Please see our Privacy Policy for details about what information is collected from you and why it is collected. We do not sell your information or use it other than as described in the Policy.

Please note that it is in our legitimate business interest to send you certain marketing emails from time to time. However, if you would prefer not to receive these you can opt-out by ticking the box below.

Alternatively, you can use the unsubscribe link at the bottom of the Demo account confirmation email or any subsequent emails we send.

By completing the form and downloading the platform you agree with the use of your personal information as detailed in the Policy.